Many thanks for another year with your best investors.

NAV rate in December was 106.79, which gives an increase for the month of 0.55 (0.52%). It's a good month, the fund is progressing according to plan. NFF thus gives an annual return of 6,79%, which I am very satisfied with.

The fund exceeds its target by about 75 points and that is great in this type of fund. The risk-adjusted return is fantastic in the fund and I am very happy with the results and the team behind the fund. For the long-term investor who does not need immediate liquidity, NFF is a very good base investment in the portfolio.

We continue our work with extra frequent follow-up of our companies with regard to the Corona situation and the time after which we find ourselves in now.

We look brightly at the possibility of growth for factoring in 2022, our partner is getting more and more assignments and that is positive. A bit of a bummer is that competition is increasing and thus pricing is getting tougher, so I think we will land closer to 6% in 2022 than 7% which was the case in 2021.

Below you see a graph of the factoring fund since inception and it has returned just over 6% per year since inception if you have reinvested the dividend since inception. Completely in line with the fund's objectives.

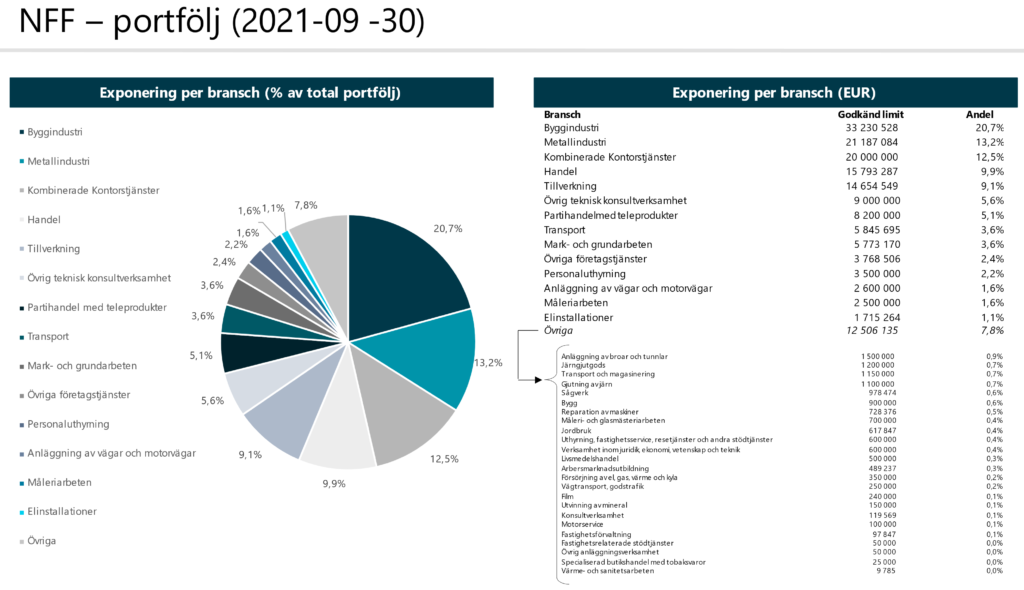

Below you can see the fund's breakdown by industry and the share in the portfolio of these.

Finserve Nordic, which is the fund's AIF manager, has in 2020 joined the company to the PRI network, Principles for Responsible investment. The network is independent but supported by the UN and encourages investors to invest responsibly by following the principles developed by the network.

All funds under Finserve's management follow the responsible investment process formalized in Finserve's Sustainability Risk Integration Policy. The policy is available on the company's website https://finserve.se/viktig-information/. Each fund's sustainability policy is available on the funds' websites

When you do your analysis of the fund, you should primarily look at the credit risk and the liquidity risk in the fund. Are you comfortable with the credit risk that the fund's holdings generate? Furthermore, the assets are illiquid and it can take some time to get your investment back if many people want to withdraw deposited funds at the same time. The fund has a low market risk and has a low correlation with other asset classes.

We emphasize that we are not stressed by non-loaned funds, but continue to work based on our models for credit assessment, all to ensure a good diversification of the portfolio in relation to the credit risk we take.

If you need to sell your holdings, do it in the primary market, where you will get the best price.