Liquidityrisky

Liquidity risk for a company is the risk that the company cannot fulfill its payment obligations at the due date, i.e. that the Fund lacks liquidity to pay, for example, invoices or redemption amounts to Investors on time. The risk arises because the Fund finances itself by issuing Profit Share Loans, which entail payment obligations towards the Investors.

The risk may increase if the Fund finds it difficult to raise capital. Liquidity risk can also arise in the Fund's Portfolio, if the assets the Fund has invested in would be difficult to dispose of or if the Fund finds it difficult to liquidate the Portfolio or if it takes longer than expected to liquidate positions and sell investments.

Liquidity risk means for a bond that it is not possible to sell the bond early. Under normal market conditions, the Market Guarantor offers a purchase price for those who want to sell early. Although bonds in the form of Dividend Loans have become more established recently, the secondary market is still limited. There is therefore a risk that the liquidity of the Profit Share Loans is low, and that they are traded at a price below the issue price.

Sometimes it can be difficult or impossible to sell Profit Share Loans during the term and it is then illiquid. This can, for example, occur in the event of strong market movements, changes in liquidity, changes in regulations, hedging ("hedging") of positions, market disruptions, communication interruptions or other events which may lead to difficulties in trading at reasonable rates or due to the market place concerned being closed, or that trade is subject to restrictions for a certain period.

Interesterisk

The value of the profit share loan is largely dependent on a number of different factors. One such factor is the market's general interest level, which is why investors in the fund's profit-sharing loans should understand that the development of the yield can be negatively affected by changes in interest levels in the markets where the fund and the borrowers operate.

Reinvestmentrisky

Long-term return opportunities on the profit-sharing loans issued by the fund are highly dependent on the fund finding new lending objects that require financing and which are also suitable based on the requirements set by the fund.

Macroeconomic risk

A sharp downturn in the country's or region's economy can affect the companies' ability to pay interest and can also lead to repayment of the loan not being completed on time or not being paid at all. For the fund, this means the risk that the invested capital will not remain intact or that the return on the invested capital will not be as high as expected or will not occur at all. However, the AIF fund has commissioned an analysis of other funds in other countries that have similar strategies, which showed that the funds were not affected at all during, for example, the latest financial crisis.

Marketingrisky

The fund's product is relatively new and unknown to smaller investors, which is why it may be difficult to reach out and attract a sufficient number of investors.

The value development of the investments

The fund offers short-term direct lending to small and medium-sized companies in order to achieve the goal of a high risk-adjusted return with low or no correlation with other asset classes. The return on its investments that the fund wants to achieve is thus directly dependent on the repayment ability of the loan objects. There is thus no guarantee that the fund's investments will yield the expected return, or that the value of the invested capital will be kept intact, which is why there is also no guarantee that invested capital can be recovered upon redemption. It should be emphasized that the fund will largely invest in small and medium-sized companies that have good liquidity and financial standing and that need extra capital for various projects. This means that the fund differs from the objects that private individuals usually have the opportunity to invest in, and also means that you as an investor get a risk diversification that is otherwise difficult to achieve as an individual investor.

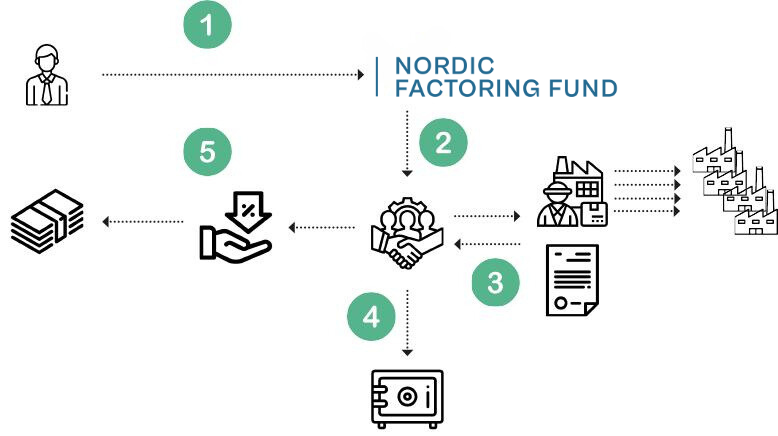

Trade with the Nordic Factoring Fund

Investment in the company's profit-sharing loan must primarily be seen as an investment for the entire term of the bond. The profit-sharing loans are freely transferable with the restrictions imposed by applicable law. The profit share loans will be listed on NGM-NDX where they are priced continuously.

The duration and volatility of the investment opportunity

Investment in the fund's strategy is associated with risk, also in terms of its duration. However, the fund assesses that the investment opportunity will remain as long as the banks' capital requirements are at least at the same high level as today. In addition, the fund's investment strategy is relatively insensitive to economic conditions, provided that market conditions do not deteriorate significantly.

Currencyrisk

The fund may make investments of a certain part of the capital in currencies other than the Swedish krona. The fund intends to currency hedge the investments made in currencies other than the Swedish krona, which is why the risk is considered to be small.

Creditrisk

The fund's investment strategy involves some credit risk as there is always a risk that the loaned capital will not be repaid to the fund at the end of the loan's term, which can affect the return. In the event of a sharp deterioration in the fund's position, the fund may be unable to fulfill its obligations according to the investment agreements entered into with the bondholders.