7.3 % return in March and 21.5 % return for Q1 2024. The strong return in Q1 2024 places Finserve Global Security Fund on the top lists of best performing funds this year but also over 3 years.

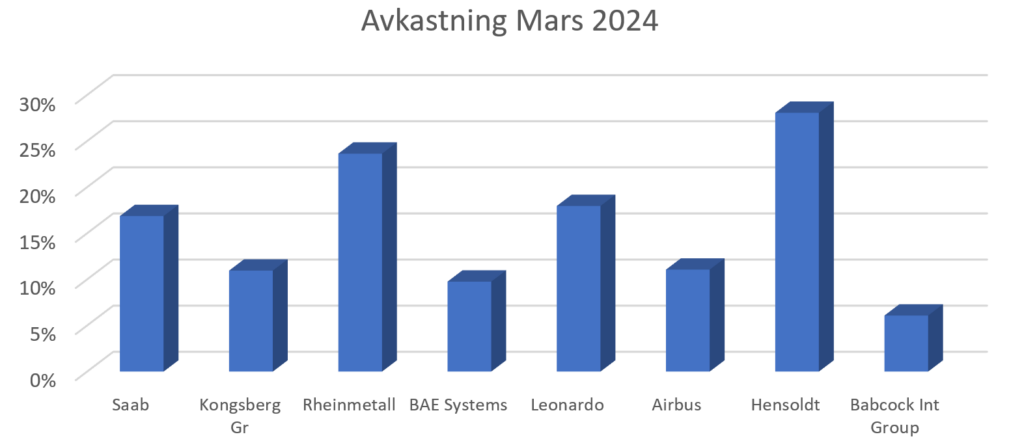

The fund increased exposure to European defense companies during Q1 has given good returns and the fund's largest position Rheinmetall was up over 23 % in March. Hensoldt stood out as the top company with a return of 28 % during March. The diagram below shows an overall strong rise in the fund's European companies.

The fund has been successful in its allocation in Europe but also underweight US defense and cyber security. Government debt, budget challenges and delayed aid packages to Europe are holding back development in American defense companies, at least temporarily. Trump's loud statements about the lack of support for Europe are not befitting an American presidential candidate. At the same time, there is probably a common view in the American Congress that Europe must take a clearer responsibility for support packages and defense investments in Europe. This means continued large defense investments in Europe will be required regardless of whether the support packages go through in the US. Germany is putting up with a lot of support in Ukraine, while France's is still limited.

Cybersecurity has stalled somewhat in returns after being the sector everyone was talking about in January. Despite this, the sector has made an important contribution to the fund's return. The slowdown in cyber security is partly due to market-leading companies' guidance against high expectations, partly due to how central banks have communicated and acted. Central banks have adjusted their statements and interest rates, and the fact that interest rates have instead started to rise has been negative for tech and cyber security.

JP Morgan & Jamie Dimon's annual newsletter to investors was released on April 8 and can be summarized as follows:

Despite a challenging market climate, the US economy remains resilient, with continued strong consumption and positive sentiment. However, we are facing the most treacherous geopolitical situation since the Second World War. We tend to exaggerate the impact on the global economy but the fact that geopolitical risks may involve events not seen since World War II. Clear inflationary pressures come from fiscal spending, new militarization in the world, investments in the green transition, as well as potentially higher energy costs.

Jamie Dimon

I think the above provides good arguments for continued diversification through the Finserve Global Security Fund. We also need a deterrent defense in Europe, it is the very foundation of our sustainable societies.