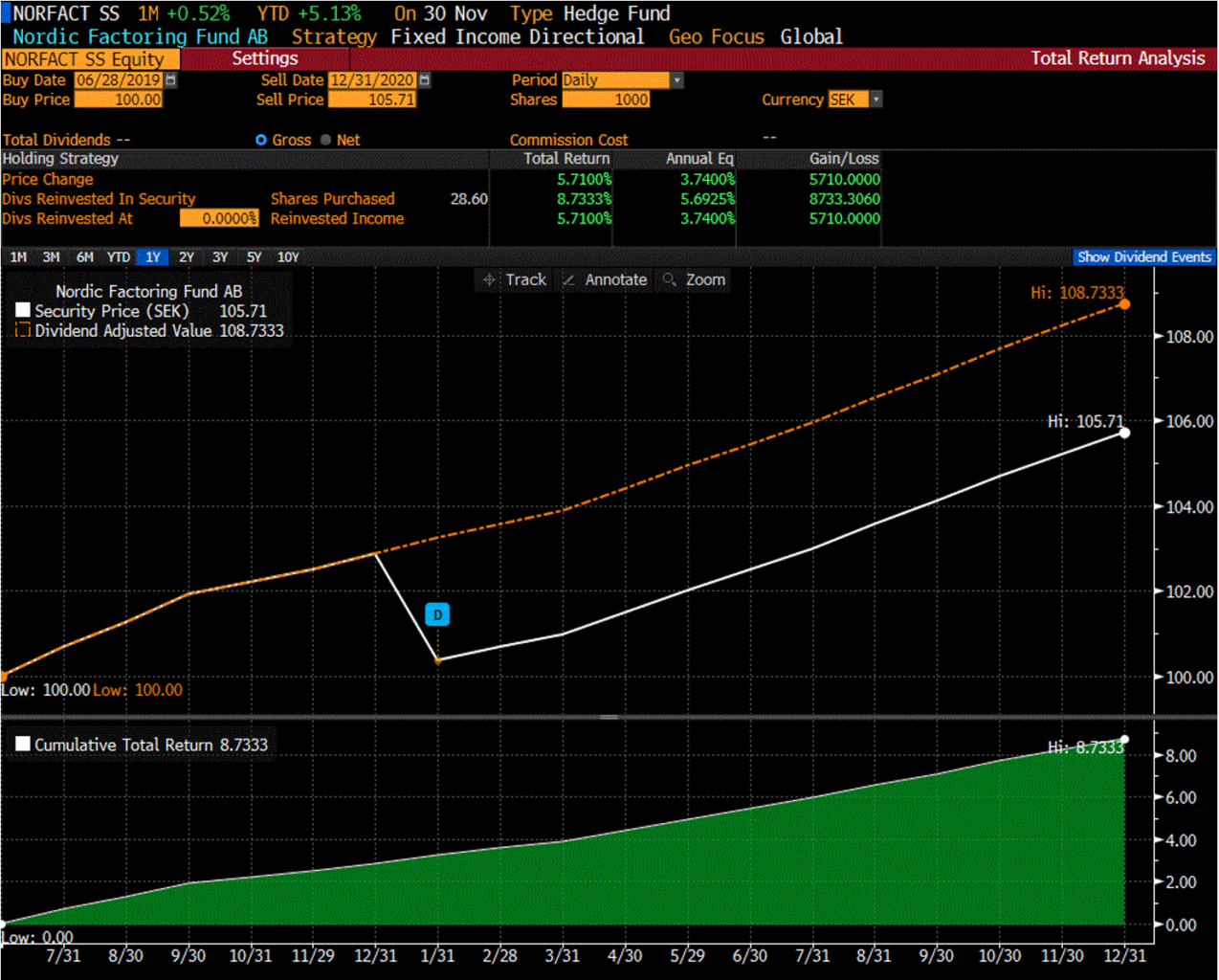

NAV rate in December was 105.71, which gives an increase for the month of 0.50 (0.48 %). A good month that is in line with the objective of rolling twelve-month figures of a return of at least 6 percent. We had legal expenses that brought the NAV down a few points.

Inflow of SEK 12 million, many thanks for that.

The new lending in December was marginal as we are already fully invested.

We have a demand surplus for factoring a bit into next year, so new investments will be put to work immediately.

We contribute to a higher risk-adjusted return if you have the fund as part of your portfolio. For the long-term investor, NFF is an excellent addition to the portfolio.

In 2021, we will introduce quarterly liquidity in the fund for redemption, we will maintain monthly investment opportunities. Details around this and when the conditions are updated, please let me know.

We are starting a new fund in 2021 that only invests in market-quoted "High Yield" bonds, it has a unique structure. Available to read about on our website. It will be a good complement to the NFF. Furthermore, the team's competence regarding analysis will be further broadened. The skills the team possesses is unique and it is a pleasure to work with them.

We continue our work with extra frequent follow-up of our companies with regard to the Corona situation. The government does everything to keep the wheels turning in as many industries as possible, the fund has no exposure to industries that are directly affected by shutdowns or restrictions. Our companies are not unaffected, it would be wrong to say that, but they are doing well on the whole.

Below you can see the fund's return since inception. It's a very nice curve and high risk-adjusted return. We are very satisfied with how the fund is developing.

The market:

This week saw activity data from Asia for December. You can see that they show growth in most places (over 50) even in countries that are heavily affected by the virus. Of the larger countries, China shows strong figures and Japan increases significantly in December compared to November. We must not forget Asia when we look at global growth, and above all Swedish companies.

We also received activity data from Sweden and it shows good growth in the industry. Furthermore, the activity index from the USA also shows strong growth.

To sum up, the industry is doing well in Sweden and the rest of the world in general. This guarantees a continued robust recovery.

2020 has been a challenging year in many ways, not least on the human level. There are probably many of you who are directly or indirectly affected, and we at the fund can only regret that. I hope that 2021 will be a year when we can return to a life without Corona. However, it will take some time before the vaccine has a full effect on society. We simply have to do the best we can in the meantime.

Ultra-easy monetary policy will continue well beyond 2021, keeping risky assets under arms for the foreseeable future. A weaker US dollar supports the developing markets, which is also good as their economies can spin further out of the Corona impact. Bond yields have priced in a lot of growth, now it needs to materialize. However, I want to warn that when signs of inflation begin to appear, long-term interest rates can rise quickly regardless of the central bank purchases, it is not a main scenario in the near term, it could possibly come into play in the second half of 2021.

The Democrats also win the Senate and that will potentially push up long-term interest rates in the US. Trump continues to do his best to stay in power by any means at his disposal. It remains a potential stink bomb if he somehow manages to fire President Biden's installation in the White House. What happened around the Capitol shows what an extraordinarily bad leader Trump is. Hope he just becomes a parenthesis in US history.

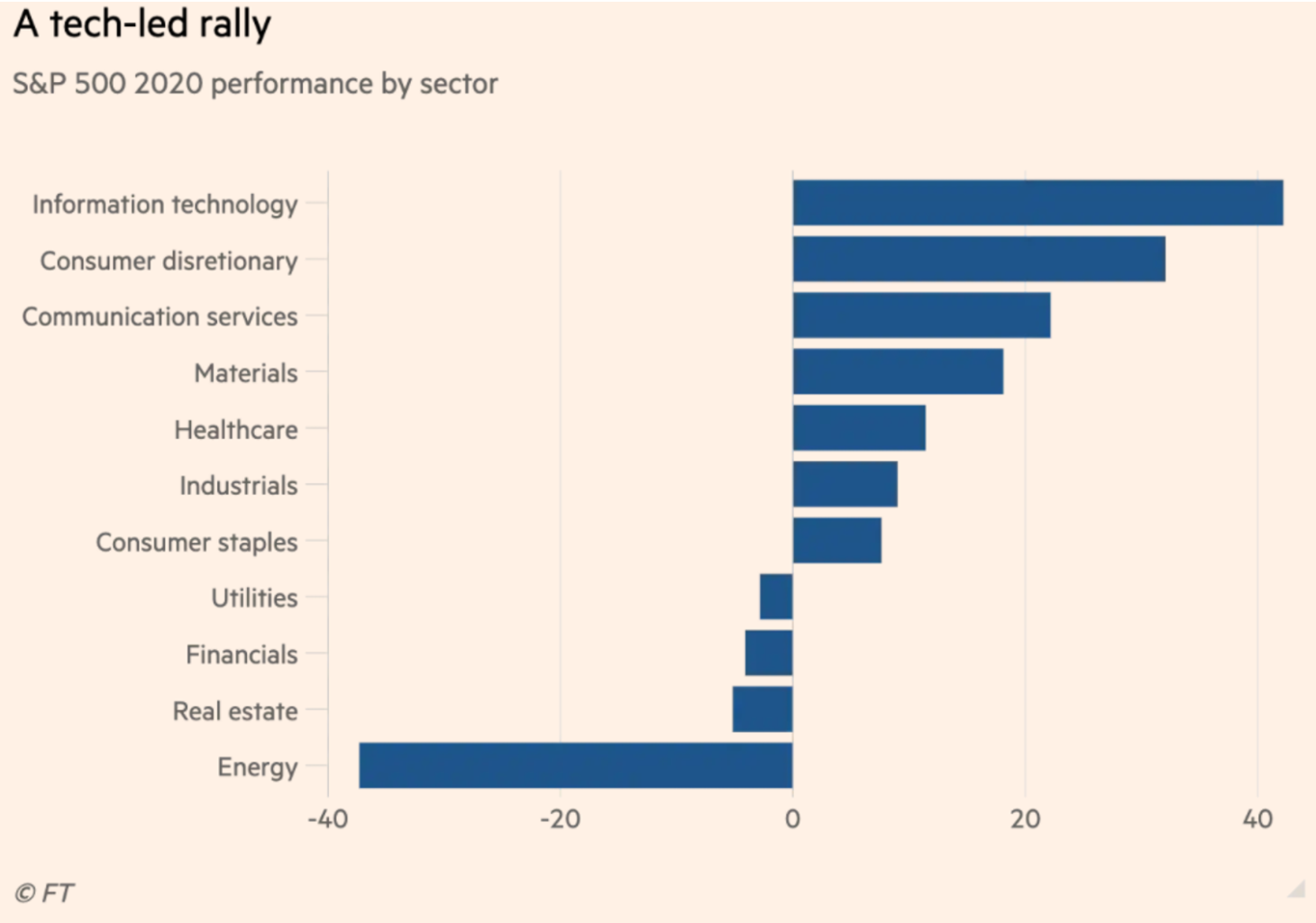

In the environment we've been in in 2020, the S&P has risen by about 16 %, and it's led by technology stocks. Below you can see the sector distribution that contributed to the rise in the S&P. Who could believe this in March when everything fell out of control. There, the central banks have done a good job through their ultra-easy monetary policy, now it is up to the financial policy to continue supporting companies and individuals who are particularly hard hit.

I agree with many who are raving about fiscal policy supporting investments aimed at reducing CO2 emissions. It will then include everything from mini-nuclear power plants of the fourth generation to water, solar and wind power plants. There are certainly other sources as well, but Sweden needs electricity, a lot of electricity, and there will soon be an electricity shortage if the entire infrastructure around electricity production and its distribution is not addressed.

Since 2020, Finserve Nordic, which manages our funds, has a strict sustainability policy. We have an employee who is dedicated to the task of ensuring that our borrowers fit within this framework. We now have a number of questions in our analysis that must be answered by prospective borrowers. We are also members of PRI, which is a global interest organization for fund managers, and we follow its sustainability standards.

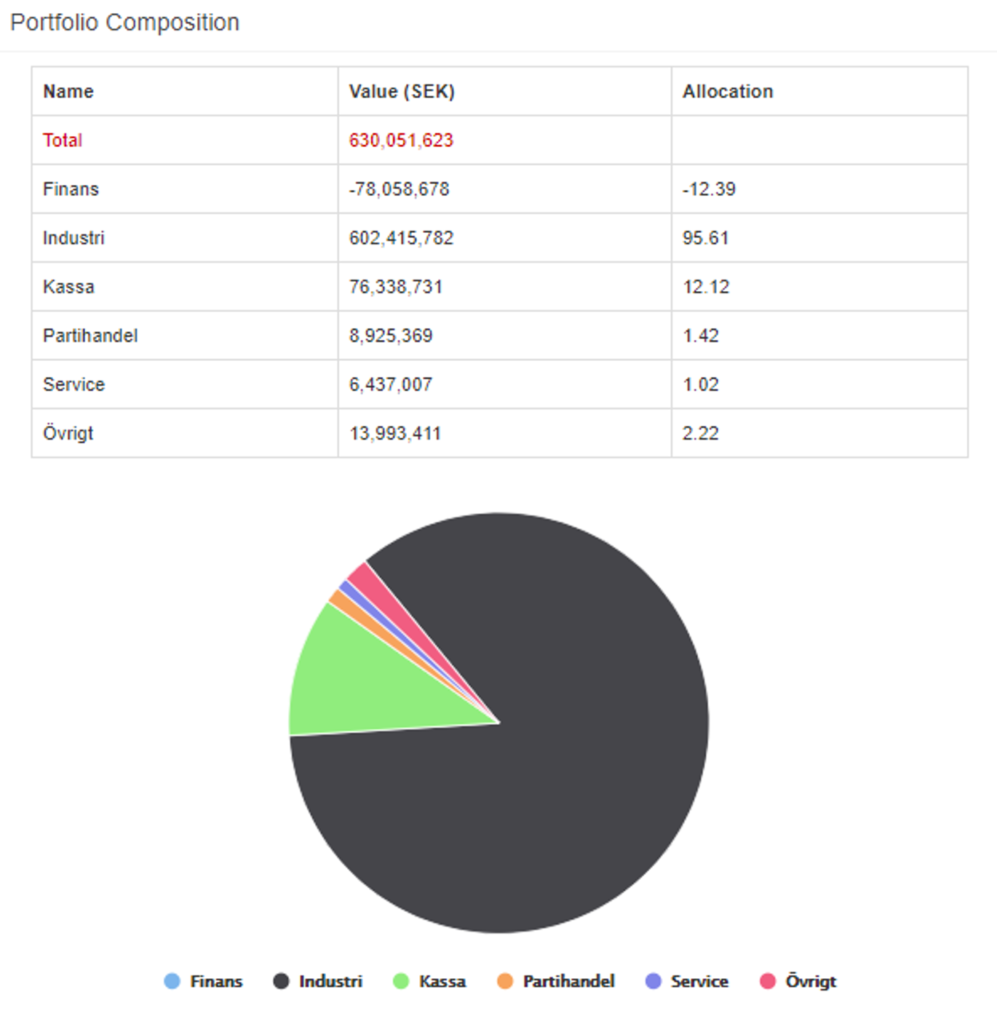

Below you can see the type of company we have financed invoice purchases from: