The NAV rate for September was 102.84, an increase of 0.40 on the month and a standard deviation of 0.92.

We have inflows in September of SEK 22 million, thank you very much for that.

New lending in September was approximately SEK 95 million, and it is primarily a larger loan that is behind that figure.

The slightly weaker NAV figure for September comes from IFRS provisions, 30-day month and market-valued holdings.

Our pipeline as of September/October for new loans is approximately SEK 870 million through Q1 2021. There is starting to be a high demand for new loans from companies. We gratefully accept all investments in the fund and it would be great if we could make some of these.

The fund has filed a lawsuit against JOOL Markets AS Filial Sverige in Stockholm District Court in early September for their actions in connection with the issuance of the Trinitas bond. What is being tested is the organizer's liability that JOOL has for the content of their investor material which was falsified and incorrect. It has never been tested in Sweden before but a well-known Norwegian investment bank lost two cases of this nature despite several pages of disclaimers. We mentioned that we intended to test this legally when we made the press release about this incident and we are doing so now.

It is of utmost importance to you as a unitholder that we always do everything we can to recover invested capital. This is an extreme event where a criminal act by the principal is the cause of the loss. In this case, there is good reason to believe that we will succeed, otherwise we would not do it. The fund has already written down the value of its holding in the bond, which means that the NAV on the day we win will be positive. You can read about this in the daily juridik at the following link: https://www.dagensjuridik.se/nyheter/jool-markets-kravs-pa-61-miljoner-kronor-efter-obligationsskandal/

The market:

The single most important event in the near future is the US election, in my opinion. I wrote in last month's letter that I think Trump will win and I still believe so (although I hope for Biden), even though I personally find it an unpleasant thought. As previously mentioned, I am most worried that Trump will not hand over power if Biden wins. That will probably lead to unrest, which in turn will put a damper on risk appetite.

In this graph you see the market's prediction of the election outcome, you can see that there is a fairly large overweight for Biden. You can also see that 6 months ago it was next to zero. A lot can happen before election day.

(source Bloomberg)

Once the election is over, I think risky assets will continue to develop well regardless of whether Trump or Biden wins, but more so with Trump as he will probably come with an expansive tax package that will be received positively by the market.

As before this year, Covid-19 is what works in the other direction. A sharp increase is underway in Europe, however, it seems that politicians are trying to keep the wheels turning as long as possible. It would be a disaster with shutdowns of the type that happened last spring.

Vaccine, it is the holy grail that we all long for, it would change the picture completely. I think the market expects an effective vaccine to be in place before the turn of the year or during Q1 2021. It is unfortunately the reverse if it is much delayed.

Risky assets have had a bit of a tough time in September with high volatility. However, October has started in a big way and the Stockholm Stock Exchange has set a new "all time high".

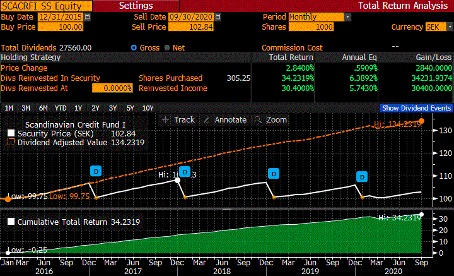

I would like to take this opportunity to show the fund's return from the start. Despite the turbulent spring, we are showing a robust return for the year.

(source Bloomberg)

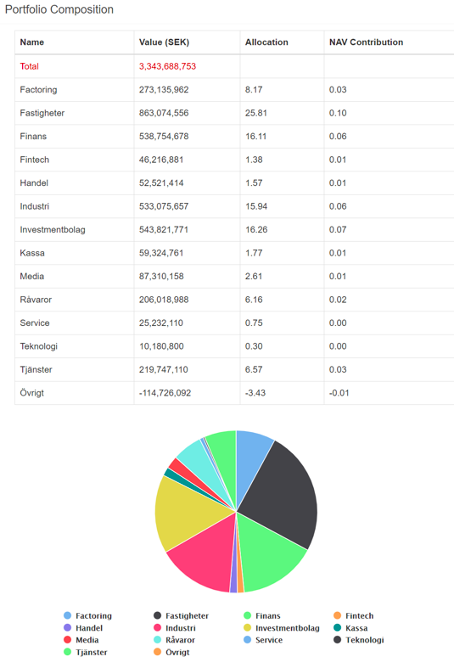

Below you can see the NAV distribution and main sectors in which the fund is invested:

[gdoc key=”https://docs.google.com/spreadsheets/d/1fImRi206U3Md8vzVZnH2mx3Hb065klUo3clboHNl0QU/edit#gid=29075506″ class=”table-striped no-datatables” datatables_paging=”false” datatables_ordering=”false” datatables_searching=”false” datatables_info=”false” header_cols=”1″]