The fund publishes information regarding repurchases as of May 4, 2020. The fund has currently issued profit-sharing loans corresponding to a value of approx. SEK 4.2 billion. In the wake of the outbreak of covid-19 in Sweden, the Fund has received an increased number of notifications of early redemptions from investors of approximately SEK 780m. The responsible manager states that under current market conditions, combined with the fund's investment strategy, there is a lack of opportunities to carry out early redemptions according to the investors' request without the risk of significantly disadvantaging other investors in the Fund.

Given the above, the board of the Fund decides the following.

- With the support of points 10.1 – 10.3 of the General terms and conditions regarding the Fund's possibility to wait to redeem profit-sharing loans, the board decides that the Fund shall handle received notifications of early redemption in such a way that the payments to the investors who requested redemption are divided and carried out continuously in pace with that the fund's liquidity allows.

Payments during the period must be distributed pro rata between investors as the Fund can liquidate positions or engagements in an orderly manner and without significant inconvenience to other investors.

Redemption must, according to point 10.3 compared to 4.11 of the General Terms and Conditions, take place at the NAV rate determined at the end of the month that falls closest before the redemption date.

- The board will continuously follow developments and make the necessary decisions on how future redemption transactions should be handled.

See further information in this FAQ.

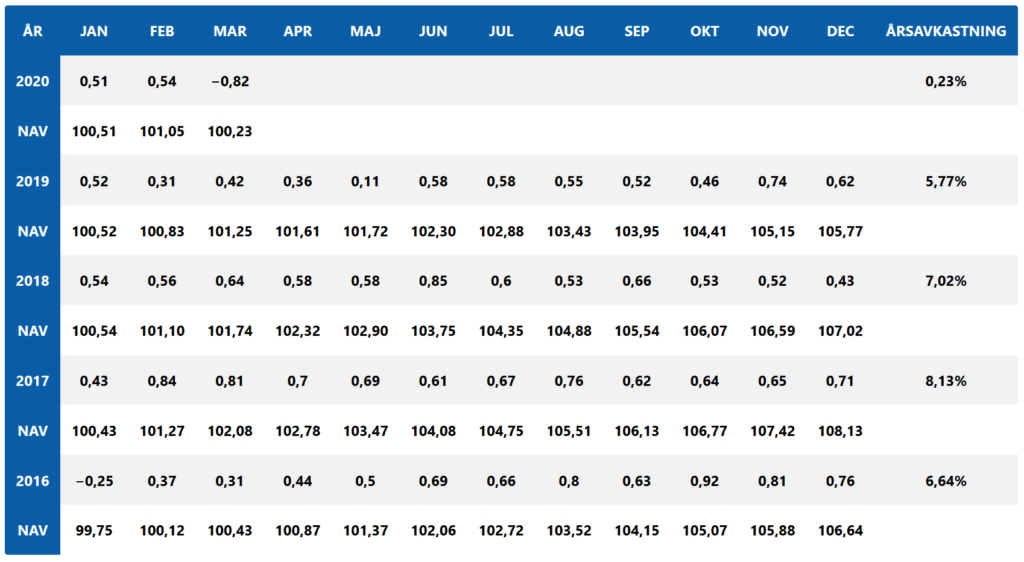

Revised expectation regarding the future development with the impact of covid-19. The company aims to achieve 6-8 % annual net returns to the holders of profit-sharing loans. Taking into account the covid-19 impact, the fund revises its expected return for 2020 to 3-5 % net return. Since inception, however, the return is within the range with an average annual return of 7.4 % per latest NAV with annual interest on interest effect.

Annual return 2016-2020

For further information, please contact:

Fredrik Sjöstrand, CEO/CIO Scandinavian Credit Fund I AB (publ), tel. 070 575 75 51, fredrik.sjostrand@kreditfonden.se

Peter Norman, CEO Skandinaviska Kreditfonden AB, tel. 0733 929 455, peter.norman@kreditfonden.se