April 2025 – The smallest companies have more company risk than market risk

The NAV price for the fund's A class was 103.14 in April. The fund's A class rose by 3.39% in April and has been around 8 percentage points better than the fund's reference index OMX Small Cap GI since its inception in December 2023.

Market

April showed a clear difference between small and large companies on the Stockholm Stock Exchange. OMX Small Cap rose by 2.3 %, while OMX30 fell. The strength of small companies was noticeable in strong quarterly reports, especially in technology, IT and industry. At the same time, Trump's tariff moves against China and the EU created unease in the markets, but small companies with a local or European focus were less affected. A weaker krona favored export-oriented small companies, and investors sought growth rather than defensive large companies.

Smaller Swedish small caps offer structural growth, low correlation to large caps and better diversification. Their historical excess returns are driven by innovation and rapid adaptation — something that April's performance clearly illustrates.

Results

The fund aims to outperform the fund's benchmark index (OMX Small Cap GI) by a few percentage points per year at lower risk than the benchmark index. The average weight of the portfolio holdings during March was 0.96%. Anything above 0.96% means that the fund is overweight the company and below 0.96% means that the fund is underweight. The fund has a realized 60-day volatility of 12.95%.

Return after fees, Class A

| April | 2025 | Since the fund's inception, Dec 2023 | |

| OMX 30 GI | -2,81% | -0,51% | 5,35% |

| OMX Small Cap GI | 2,32% | -2,25% | -4,91% |

| Finserve Micro Cap A | 3,39% | -4,24% | 4,12% |

Best companies in the portfolio and average weight during the month

| Name | Yield % | Contribution % | Weight % |

| Bonava AB | 42,27 | 0,70 | 2,03 |

| Dynavox Group AB | 41,53 | 0,51 | 1,47 |

| Berner Industri AB | 25,96 | 0,33 | 1,40 |

| Synact Pharma AB | 27,22 | 0,23 | 0,95 |

| MedCap AB | 26,45 | 0,23 | 0,97 |

Worst company in the portfolio and average weight during the month

| Name | Yield % | Contribution % | Weight % |

| Net Insight AB | -36,93 | -0,36 | 0,78 |

| Alligo AB | -18,01 | -0,19 | 0,96 |

| Enea AB | -6,92 | -0,19 | 0,91 |

| Humble Group AB | -13,13 | -0,13 | 0,92 |

| Viaplay Group AB | -24,01 | -0,12 | 0,47 |

Index comparison

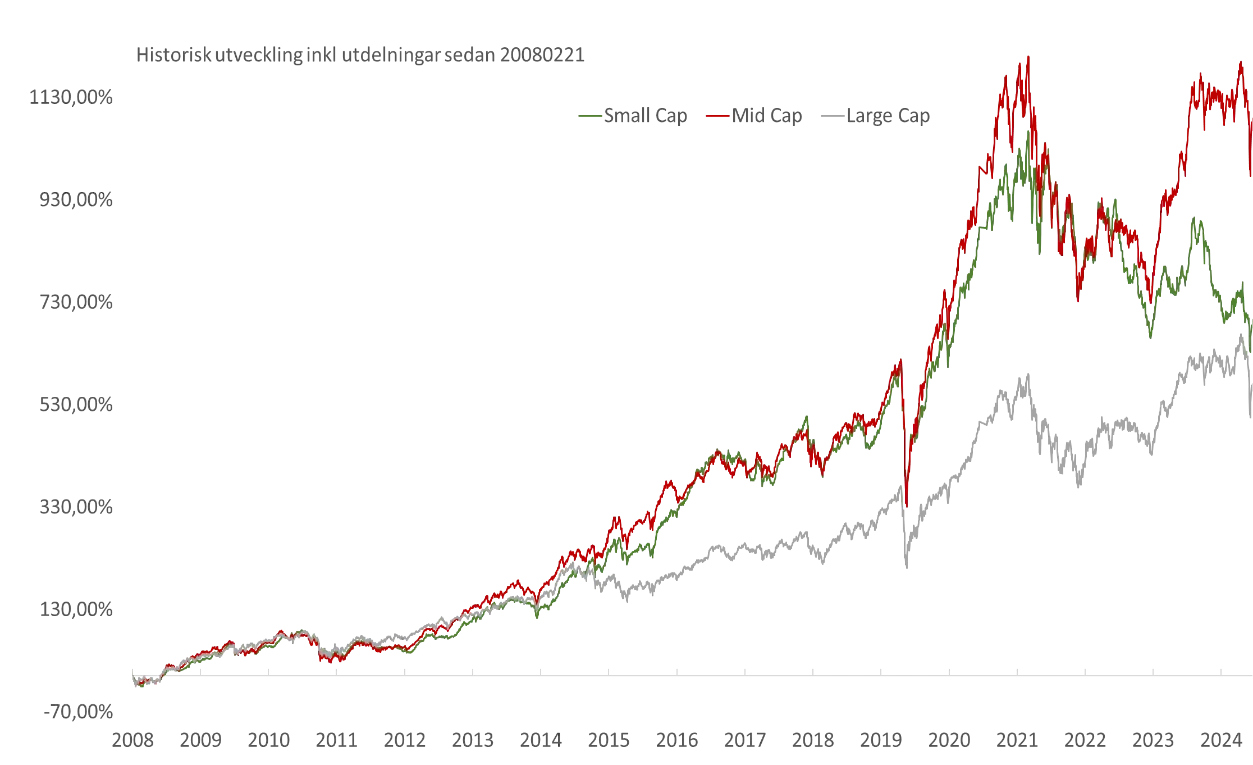

The gap or so-called spread remains large between large and small cap companies. OMX Small Cap performed marginally worse than OMX Mid Cap and a couple of percentage points better than OMX Large Cap during the month.

The chart shows OMX Small Cap (green) compared to OMX Mid Cap (red) and OMX Large Cap (grey) since 20081120. Source: Infront

| Small Cap Index: Company value less than approximately SEK 1.5 billion. |

| Mid Cap Index: Company value between approximately SEK 1.5 and 12 billion. |

| Large Cap Index: Company value greater than approximately SEK 12 billion. |

Did you know that?

Few funds own companies on the OMX Small Cap list.

Click on the link to read the fund in Finwire's email interview.

A systematic strategy for investing in smaller companies – Finserve Micro Cap Fund

Strategy

The fund's goal is to achieve good risk-adjusted returns, offer equity exposure to companies that few other funds own, and to weather downturns well through equal weighting and even sector exposure.

The fund rebalances all positions every six months. Historically, the strategy of equal-weighting a broad equity portfolio has resulted in higher risk-adjusted returns compared to market-value-weighted broad portfolios. This outperformance can be attributed to the strategy's ability to better handle downturns, unlike value-weighted portfolios that are often heavily concentrated in individual stocks. The strategy is based on trend-following investments between equal-weightings, focusing on companies that exhibit low volatility and a clear positive trend.

Finserve Micro Cap invests in companies listed on the regulated market. The portfolio consists of more than 100 companies listed on the OMX Small Cap and OMX Mid Cap lists over time. The companies in the portfolio have an average company value of approximately SEK 2.5-3.5 billion over time. This value is significantly lower than the average among competitors' micro cap and small company funds.

Thanks to regular equal weighting, the trend strategy and the fact that the fund is one of the few fund owners in many of the companies, the fund has a low correlation with traditional micro cap and small cap funds.