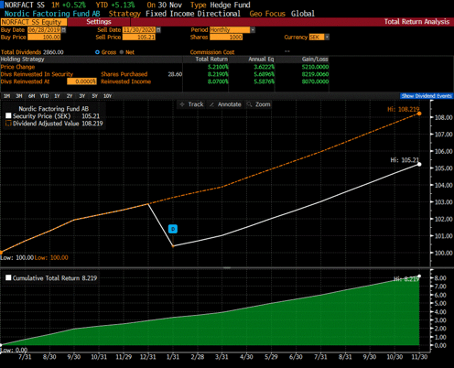

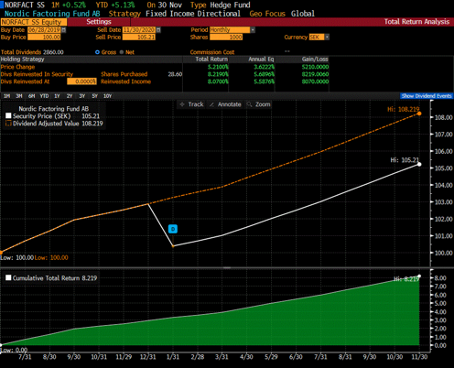

NAV rate in November was 105.21, which gives an increase for the month of 0.54 (0.52 %). A good month that is above the target of a rolling twelve-month figure of at least 6 percent.

Inflow of SEK 12 million, many thanks for that.

New lending in November was approximately SEK 19 million. The fund is fully invested. We have a demand surplus for factoring a bit into next year, so new investments will be put to work immediately.

Our work with extra follow-up of our borrowers, which is driven by the second wave of covid-19, is ongoing, and going well. We have not had to make any concessions that affect the portfolio to any extent, there are marginal adjustments to IFRS this month. I want to emphasize that our exposure to hospitality, transport, tourism etc. is zero.

Below you can see the fund's return since inception. It's a very nice curve and high risk-adjusted return since inception. We are very satisfied with how the fund is developing.

The graph below shows all months in the fund since the start, we have no negative months, how many funds can show that during this period?

The market:

During November we experienced one of the best single months for risky assets in modern times, congratulations to everyone who was overweight stocks in eg Spain, UK etc.

We have received:

- New President of the United States Joe Biden wins convincingly, the market (and I) like it. This hopefully means that the US will once again become a stabilizing factor in the world instead of only thinking about its voters in the Midwest. I further hope that the rhetoric will return to something that does not resemble the level of a snarky child with sand in his eyes, but becomes statesmanlike and respectful of everyone's opinions.

- The market also likes the Democrats not winning the Senate so they can pursue policies that are stifling to growth.

- Vaccine is underway and vaccinations will start in the UK next week.

- Central banks continue to emphasize ultra-easy monetary policy and that it will last for years to come.

Government bond interest rates are around zero and are not an option for those who want a return on their capital.

All this has contributed and will contribute to a positive sentiment in the near term.

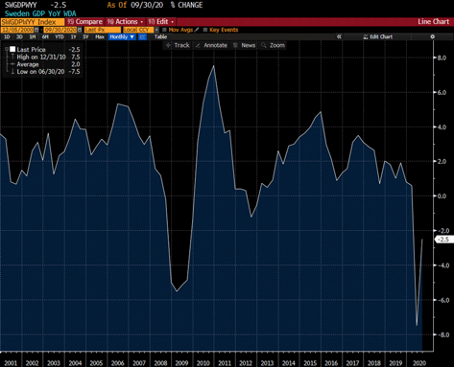

In the graph you can see Sweden's GDP growth since 2000 and with it I want to illustrate that with the right measures the economy will return to growth eventually, it will work out this time as well. The GDP drop was actually greater during the financial crisis, but it was less noticeable, because then there were no restrictions on how we should live our lives.

What do potential risks look like going forward?

- Risky assets have once again run off a little too violently and the real economy with fiscal policy is lagging behind. We see signs that Poland and Hungary are preventing the EU from implementing the huge aid package they voted through last summer because they cannot accept the writing that a condition for aid is that countries must follow "democratic principles" (just because Trump is gone, the powers of darkness are not gone, we have them up close)

- Vaccination takes time, there are setbacks to vaccines. I am very worried that in Europe, and especially in Sweden, the preparations for mass vaccination are poorly planned. The government considers the regions to be responsible and vice versa. Ultimately it hits a service sector that is limping precariously let's hope I'm wrong.

- Inflation will not come this year and maybe not in the next few years. The more I call the wolf, the less likely anyone will listen when it comes.

- When the asset purchases of long government bonds cease, long-term interest rates will rise dramatically and this will shake up risky assets. It will be a delicate balancing act for central banks around the world.

The world needs growth and some inflation to reduce the debt burden that has now been built up for a short time, it was big before and now it has disappeared in some places. However, it is right to stimulate a lot, it is the way back that can get a little worried.

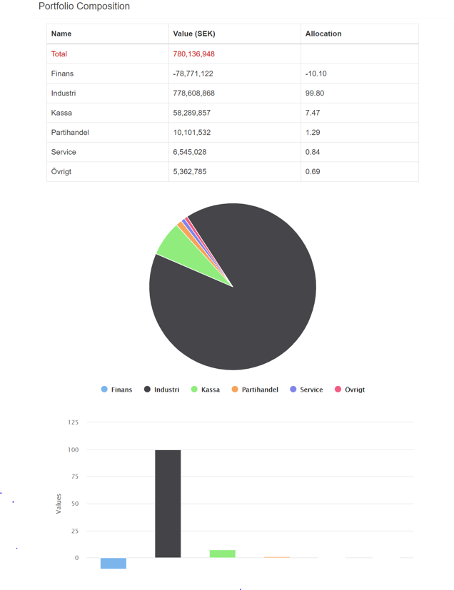

Below you can see the type of companies we finance invoice purchases from: