NAV rate in October was 105.67, which gives an increase for the month of 0.57 (0.5423%). It's a good month, the fund is progressing according to plan.

Inflow of SEK 51 million, many thanks for that.

New lending in February was approximately SEK 90 million.

We continue our work with extra frequent follow-up of our companies with regard to the Corona situation and the time after which we find ourselves in now.

The market:

I thought I would include a macro update in this monthly newsletter.

My impression of fundamental statistics that have come in during the year is that they are of the positive kind. The reality is not always what the eye sees, in the graph below that shows whether the statistics surprised positively or negatively (even if they are positive), since this summer it has surprised negatively. The market reacts to statistics that deviate from expectations priced into current asset prices. This could be one of the explanations for the somewhat shaky stock market we saw during the autumn.

(source Bloomberg)

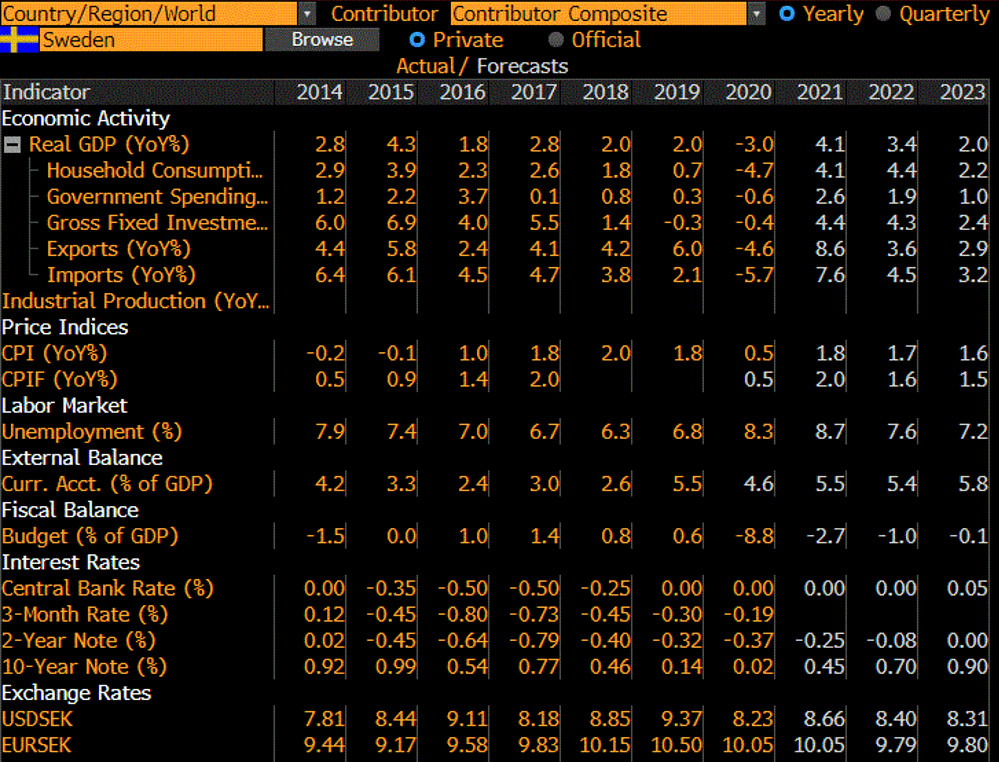

In the graph below, we see a compilation of fundamental statistics regarding Sweden from around 20 banks. It is striking how certain everyone is that the inflation we are now seeing is temporary. It coincides with the falling rate of increase in growth that we can also read in the compilation. The very large fiscal stimulus in the wake of the pandemic is winding down and the economy must once again stand on its own two feet.

It is an election year in Sweden next year, we can safely expect that a stimulating fiscal policy will last beyond 2022. Today, a Swedish ten-year government bond rate is 0.35% in yield, the forecast here is 0.90 in 2023. This can only be interpreted as when the Riksbank stops buying bonds, all else being equal, long-term market interest rates will rise.

Is the risk in these numbers on the upside or the downside? Regarding inflation, I am quite sure that the risk is on the upside.

We have: rising energy prices, rampant freight prices, bottlenecks due to supply shortages of e.g. semiconductors, rising food prices, rising fuel prices, etc. It is only about 12 years since the Riksbank raised the interest rate when we had our last financial crisis. It's easy to forget, with hindsight it was totally the wrong move at the time. The companies come where it is possible to raise prices to the end customer.

(source Bloomberg)

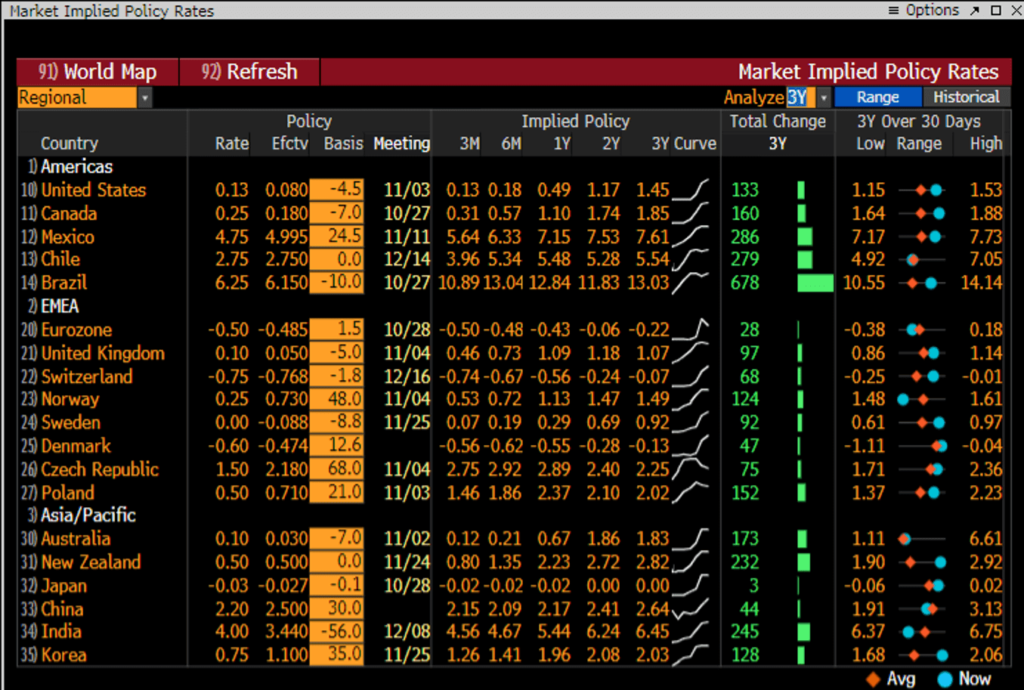

In the graph below, you can see the market's pricing of the repo rate around the world. Today's reality as priced by the market and the rhetoric from the central banks are not in sync. The market is always quicker to react, we'll find out who is right in a few years. The important thing is to relate to what is discounted in today's asset prices, for a change there, positive or negative surprises from today's and expected fundamental statistics are required.

(source Bloomberg)

Finserve Nordic, which is the fund's AIF manager, has in 2020 joined the company to the PRI network, Principles for Responsible investment. The network is independent but supported by the UN and encourages investors to invest responsibly by following the principles developed by the network.

All funds under Finserve's management follow the responsible investment process formalized in Finserve's Sustainability Risk Integration Policy. The policy is available on the company's website https://finserve.se/viktig-information/. Each fund's sustainability policy is available on the funds' websites

When you do your analysis of the fund, you should primarily look at the credit risk and the liquidity risk in the fund. Are you comfortable with the credit risk that the fund's holdings generate? Furthermore, the assets are illiquid and it can take some time to get back your investment if many people want to withdraw deposited funds at the same time. The fund has a low market risk and has a low correlation with other asset classes.

We emphasize that we are not stressed by non-loaned funds, but continue to work based on our models for credit assessment, all to ensure a good diversification of the portfolio in relation to the credit risk we take.

If you need to sell your holdings, do it in the primary market, where you will get the best price.