NAV rate in August was 104.56, which gives an increase for the month of 0.58 (0.5578%). It's a good month, the fund is progressing according to plan. I see a NAV of 6.5-7.0% by the end of the year, given the information I have today.

Inflow of SEK 51 million, many thanks for that.

We potentially have a really big pipeline for the fall, we'll see what becomes of these prospects.

New lending in August was approx. SEK 0m, the fund did well despite increased liquidity in the fund.

The market

August has been characterized by volatility mainly in the stock markets around the world.

It is on the one hand continued low interest rates that provide support, on the other hand we have concerns about inflation, the delta virus and its progress worldwide.

In the interest rate markets, the difference between worse and better credits has continued to be compressed. Companies that two years ago would have been happy to borrow at 8% can now borrow at 5-6% yield.

It also affects us to some extent, with an unchanged security package we cannot charge the same interest rate as 24 months ago. Having said that, we are making good progress and I am optimistic about the autumn.

Trend in the direct loan market

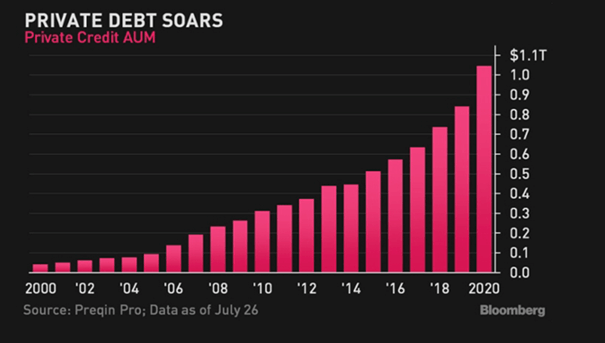

For those of you who believe in direct loans as an asset class to bet on, you are not alone. The inflow to global direct loan funds that are admittedly for institutional capital is increasing exponentially. When bond yields fall, investors look for alternatives. Direct loans offer a target return of between 5-8% per year at low volatility.

As an investor, you give up some liquidity but on the other hand get a high risk-adjusted return. The Nordic Factoring Fund is certainly a good example of this.

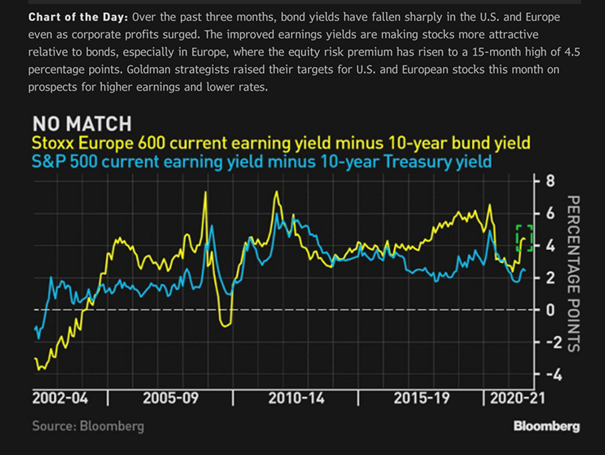

One bullish on stocks is Goldman and that can be illustrated by the graph below, with its accompanying text. My analysis of this is that as long as the market sees low bond yields, this will probably support risky assets. As you know, I am worried about future inflation and higher bond yields. I share that concern with, for example, Bill Gross, one of the world's most famous bond investors, who sees the US 10-year interest rate at 2% at the end of the year.

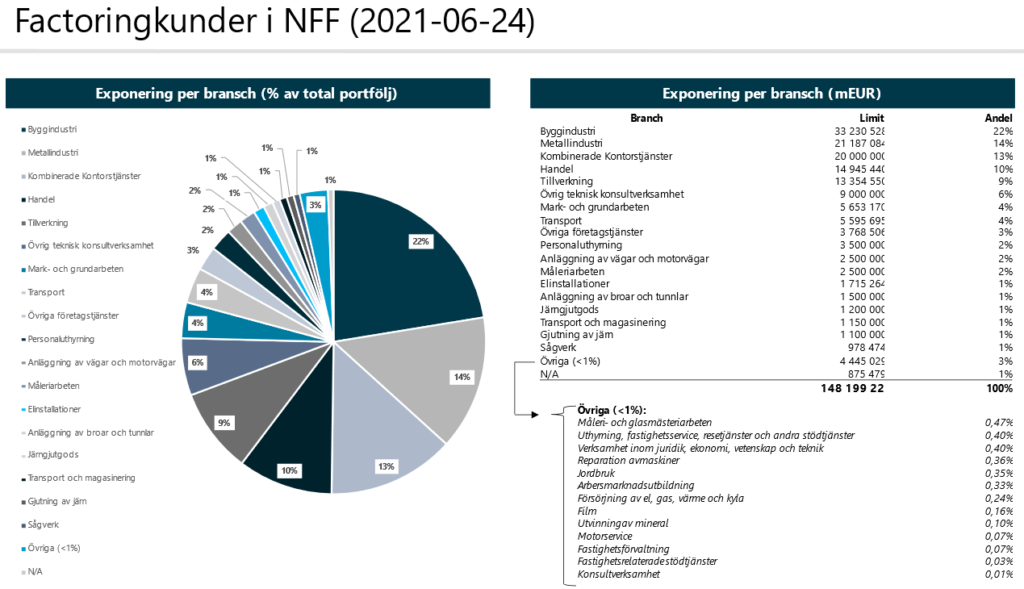

Below you can see how the fund is invested. Although the image is a couple of months old, the distribution is the same, so it illustrates the distribution well.

We have introduced quarterly liquidity in the fund for redemption on 2021-07-01, we maintain monthly investment opportunity. Redemption must be notified at least 90 days before redemption.

We continue our work with extra frequent follow-up of our companies with regard to the Corona situation.

Finserve Nordic, which is the fund's AIF manager, has in 2020 joined the company to the PRI network, Principles for Responsible investment. The network is independent but supported by the UN and encourages investors to invest responsibly by following the principles developed by the network.

Finserve Nordic believes that the integration of sustainability risks is an important part of the funds' investment processes. Sustainability risks are defined as environmental, social or corporate governance-related circumstances that could have a significant negative impact on the value of investments.

Social aspects include e.g. human rights, labor rights and equal treatment. Environmental aspects are e.g. the companies' impact on the environment and climate. Corporate governance aspects are e.g. anti-corruption, shareholders' rights and business ethics

All funds under Finserve's management follow the responsible investment process formalized in Finserve's Sustainability Risk Integration Policy. The policy is available on the company's website https://finserve.se/viktig-information/. Each fund's sustainability policy is available on the funds' websites.

The fund's AUM is less than the granted limits of approx. SEK 1.5 billion. This compilation does not come straight out of the system without a lot of manual work so it will not be included every month. It will be interspersed with the usual compilation.

(the fund uses its ability to leverage, hence the positive and negative allocation figures)

When you do your analysis of the fund, you should primarily look at the credit risk and the liquidity risk in the fund. Are you comfortable with the credit risk that the fund's holdings generate? Furthermore, the assets are illiquid and it can take some time to get your investment back if many people want to withdraw deposited funds at the same time. The fund has a low market risk and has a low correlation with other asset classes.

We emphasize that we are not stressed by non-loaned funds, but continue to work based on our models for credit assessment, all to ensure a good diversification of the portfolio in relation to the credit risk we take.

If you need to sell your holdings, do it in the primary market, where you will get the best price.

If you are in a hurry to sell, the secondary market may be an option. The official NAV rate is published on the first banking day of each month, what is shown during the month on NGM is not, I want to emphasize not always the official NAV rate, as fund units may have been traded in the secondary market at a different rate than the official NAV.