The Nordic HY market has developed well during August with demand-driven spread convergence in the SEK and NOK markets.

The EUR and USD market has been more neutral but USD HY has performed better in the last week in line with better stock market development. The SEK and NOK market suffers from a shortage of material in the primary market as there have only been a few issues so far (Walenius Wilhemsen (NOK), Trym AS (NOK), 24Storage (SEK), Dooba Finance (SEK), Ilja Batljan Invest (SEK), Genova Property (SEK), Axactor (EUR), DNO (USD).

Many investment funds have had inflows during the summer and need to use their cash, which has meant that they have been looking for bonds to invest in from the secondary market, which is driving up the spreads in SEK and NOK.

Several banks say that there is a good pipeline for new issues of HY bonds in the future and the market will swallow it easily given the good sentiment in the market. The lack of alternative investments means that those who think the spreads have narrowed too much are buying anyway.

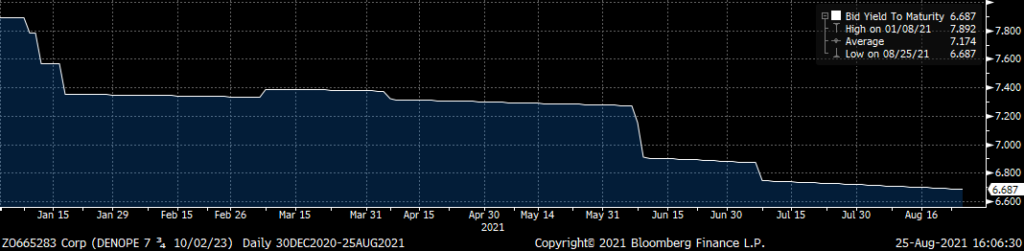

Attached is a graph of how Dentalum's (yield) and SIBS (spread over STIBOR) issuance in SEK has developed during the year. Entirely driven by material shortages and if it is also non-Real Estate, it is very difficult to find material. If you also spice it up with a green framework, the demand becomes hysterical.