Fund development

You can find complete information about Finserve's funds in the funds' Fact Sheets and Information Brochures. On the same page, you will also find other documents including full and half-year reports. The material on these pages is intended as general product information only. It should not be seen as investment advice or investment recommendations, and should not be used as a basis for investment decisions. You should always read the fund's Fact Sheet and Information Brochure/Prospectus before you start saving in a fund. We cannot guarantee that the information is complete and it is subject to change without notice. The published share value (NAV rate) is based on the most current data available.

Why this fund?

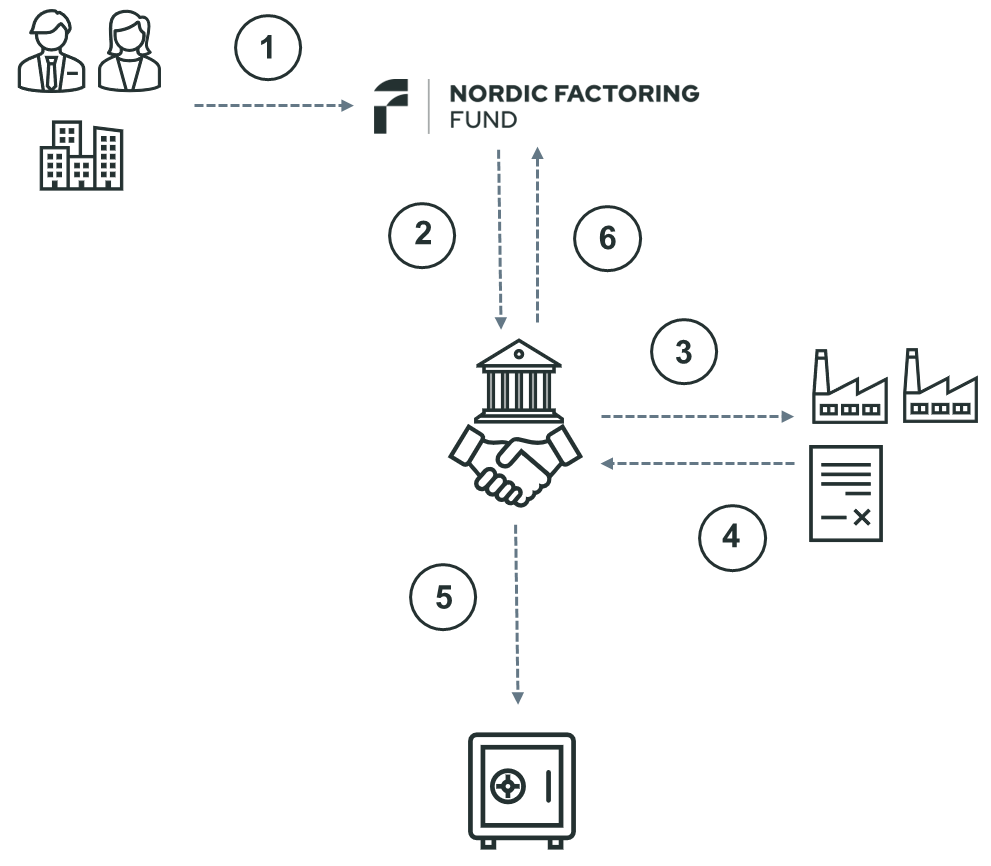

How the fund's return works – in 6 steps

- You invest by buying shares in the fund.

- The fund collaborates with factoring companies that purchase invoices from companies approved by the fund.

- The factoring company ensures that the invoice recipient has received the goods or services before financing takes place.

- The invoices are pledged in the name of the fund and serve as security.

- The factoring company ensures that payment is made, and the fund receives interest on the invested capital.

- Interest income increases the fund's value (NAV), which provides returns to investors over time.

Quick facts

- The AIF manager is Finserve Nordic AB

- Issuer is Mangold Fondkommission AB

- Stock exchange/listing takes place on NASDAQ

- Market Maker is ABG Sundal Collier ASA

- Custodial institutions are Danske Bank A/S, Denmark, Sweden Branch

- Independent valuation function consists of independent function within Finserve Nordic

- The compliance function – Mangold AB

- Auditor is PwC by Peter Sott

Who can invest

Private individuals

Anyone who has a custody or VP account through a bank or brokerage firm can invest in Profit Sharing Loans, as these are listed on NASDAQ.

Profit sharing loans can also be an asset type in a deposit insurance (capital insurance or pension insurance) or investment savings account (ISK). When investing via deposit insurance or ISK, contact should be made beforehand with your insurance company or your bank/fund commissioner if possible.

Business

Anyone who has a custody or VP account through a bank or brokerage firm can invest in Profit Sharing Loans, as these are listed on NASDAQ.

Profit share loans can also be an asset type in a deposit insurance (occupational pension or endowment insurance). When investing via deposit insurance, contact should be made with your insurance company before investing to ensure that it is possible.

Discretionary management assignments

Anyone who manages discretionary management assignments can invest in Profit Sharing Loans, as these are listed on NASDAQ.

Professional investors

Professional investors can invest in Profit Share Loans if current legislation and management mandates allow it. Contact Nordic Factoring Fund for more information.

Information

Drawing

Sales and redemption of profit share loans take place on the first banking day of each month.

Registration must be made on a special form. (Subscription can take place 4 banking days before each change of month, February to December, not January). You will find the form under Documents on this page.

Subscription can also be done with BankID via Mangold Fondkommission AB

The minimum amount for subscription is SEK 100,000.

Management concept

Investment process

The investment objects are approved by an investment committee after a well-developed credit process. The fund strives to consistently enter into engagements with borrowers whose expected return is attractive in relation to the credit risk involved in the engagement. The individual commitments are balanced against each other in order to achieve an effectively balanced credit risk for the fund as a whole. The investment objects have a low correlation with other markets and the risk in the fund must primarily be driven by credit risk and return for the fund as a whole.

Direct lending to companies

The fund's lending objects are primarily found throughout Scandinavia and are aimed at companies that are in some form of expansion, investment, refinancing, restructuring, generational financing, seasonal or other needs.

Fund units

The fund can, on a selective basis, place funds in fund shares in similar funds without geographical restriction.

Derivative

The fund has the option of using derivative instruments, partly to reduce risks that are undesirable, partly to obtain exposures that are deemed attractive for the fund and its risk profile.

Interest-bearing instruments

The fund can invest liquidity in bonds.

Deposit to bank

The fund can place liquidity with credit institutions after a credit check.

Management fee

Management fee is paid partly in the form of a fixed remuneration, partly in the form of a profit-sharing remuneration.

The fixed compensation amounts to 1.6 percent per year. The fixed compensation is paid quarterly.

Profit sharing amounts to 20 percent of the fund's increase in value in addition to the average return on 3-month treasury bills after the "high watermark". High watermark means that the fund only pays a performance-based fee after any underperformance from previous periods has been compensated. The performance-based compensation is paid annually.

Brokerage, clearing fees and other transaction costs attributable to the fund's investments are paid on an ongoing basis by the fund.

Redemption

The fund will be open for Early Redemption on January 1, April 1, July 1 and October 1. In order for the fund to be able to plan its liquidity, we need to receive requests for early Redemption 90 days before the next quarter. In practice, this means that redemption needs to be available to us no later than December 31, March 31, June 30 and September 30 in order to receive redemption for the next calendar quarter.

The fund's liquidity under normal conditions amounts to 3-6% of the portfolio. If the Fund lacks sufficient liquid funds, funds for redemption must be acquired by divesting parts of the Portfolio. If such divestment due to prevailing market conditions or according to the Fund's assessment would significantly disadvantage other Investors, the Fund may delay such divestment until such divestment can take place in good order.

If funds for redemption need to be acquired through the sale of property included in the Fund, the sale must take place and the redemption executed as soon as possible. The fund may postpone the sale and redemption of the shares, if there are special reasons for the measure and it is justified by taking into account the interests of the Investors.

Redemption takes place at the NAV rate determined at the end of the calendar year quarter closest to the redemption date.

You can find the redemption form under Documents on this page.

Documents

Financial calendar

You will find all existing financial reports under the Documents section.

August 29

2025

Half-year financial statements 2025

February 28

2026

Annual Report 2025

Deposit and withdrawal

Deposit

January 27

2026

LAST DAY FOR DRAWING

January 29

2026

LAST DAY FOR CASH

01 February

2026

DRAWING DAY

Withdrawal

April 2

2026

FORM AVAILABLE TO US

July 01

2026

SETTLEMENT DAY

July 10

2026

WHEN WILL PAYOUT TAKE PLACE

Deposit

February 24

2026

LAST DAY FOR DRAWING

February 26

2026

LAST DAY FOR CASH

02 March

2026

DRAWING DAY

Withdrawal

July 03

2026

FORM AVAILABLE TO US

01 October

2026

SETTLEMENT DAY

October 12

2026

WHEN WILL PAYOUT TAKE PLACE

Press releases

Nordic Factoring Fund AB (publ) – Publishes NAV price 100.29 for January 2026

2026-02-04 18:38 CET

Stockholm, February 4, 2026 – Nordic Factoring Fund AB (publ), (hereinafter referred to as the Fund), in which the general public and institutional investors have been offered to subscribe for Profit Sharing Loans.

Nordic Factoring Fund AB (publ) – Publishes record date 2026 (correction of sending date)

2026-01-12 16:27 CET

Stockholm, January 12, 2026 – Nordic Factoring Fund AB (publ), (hereinafter referred to as the Fund), in which the general public and institutional investors have been offered to subscribe to Profit Sharing Loans.

Nordic Factoring Fund AB (publ) – Announces record date 2026

2026-01-12 16:15 CET

Stockholm, January 12, 2025 – Nordic Factoring Fund AB (publ), (hereinafter referred to as the Fund), in which the general public and institutional investors have been offered to subscribe to Profit Sharing Loans.

Nordic Factoring Fund AB (publ) – Publishes NAV price 105.62 for December 2025

2026-01-05 15:33 CET

Stockholm, January 5, 2026 – Nordic Factoring Fund AB (publ), (hereinafter referred to as the Fund), in which the general public and institutional investors have been offered to subscribe to Profit Sharing Loans.