Fund facts

Investment manager

Finserve Nordic AB

Depository

Caceis Bank

Administrative Agent

Caceis Bank

Auditor

Deloitte Audit

ISIN

LU2553414561

Fixed fee

0,80%

Registered Office of the Company

11-13, boulevard de la Foire L-1528 Luxembourg Grand Duchy of Luxembourg

Board of Directors of the Company

Carl Barbäck, ISEC

Joakim Stenberg, Finserve Nordic AB

Klaus Ebert, Klaus EBERT S.à rl

Why this fund?

Investment philosophy

- Factoring is a well-established financing method where companies free up capital by selling their receivables

- As an asset class, factoring provides stable cash flows and short maturities, making it a flexible investment opportunity with low volatility

- Factoring provides direct insight into counterparties' cash flows through payment and sales patterns, enabling a deeper analysis of business trends compared to other forms of financing

- This transparency enables us to quickly identify new risks and take proactive measures to minimize credit losses by ceasing funding for specific invoices

- With short credit durations (typically 30–90 days), investors can rapidly adjust portfolio exposures and concentrate on counterparties aligned with our risk appetite

- This flexibility is crucial for effective risk management and optimizing returns in a dynamic market environment

Investment strategy

- The fund's investment strategy focuses on financing factoring companies in the Nordic region, primarily in Finland and Sweden. Operating under the EU regulatory framework ensures a stable, well-regulated environment and a deep understanding of local market conditions

- The fund finances fully collateralized invoices, backed by receivables, providing a secure foundation for its investments.

- The fund strategically targets subcontractors with low counterparty risk, typically working with large, financially stable customers, ensuring a high degree of security for investors

- The fund's credit exposure is primarily to high-quality counterparties, many of which hold investment-grade ratings, with an average rating of AA

- Factoring offers transparency into counterparties' payment and sales patterns, allowing the fund to swiftly identify risks and proactively mitigate credit losses by ceasing to finance higher-risk invoices

- The fund's objective is to deliver solid, risk-adjusted returns with low volatility and minimal correlation to other asset classes, providing stability and consistent performance, even in uncertain market conditions

Master fund

Finserve Factoring Fund AB (Publ), Master Fund Investing Strategy The Master Fund's strategy is to find investment opportunities through the granting of loans or other loan operations (hereafter referred to as "Lending"). Possible lenders (the "Lenders") are, for example, companies that are in some form of expansion, investment, restructuring, refinancing bridge financing, generational shift financing or with seasonal needs. The Master Fund's potential Lenders are primarily found in Scandinavia as well as Finland.

Finserve Factoring Fund – Lux Feeder Fund

Finserve Factoring Fund Lux - qualifies as a feeder fund within the meaning of the AIFM Law and shall have all times an exposure of at least 85% of its assets to Nordic Factoring Fund AB, an investment fund incorporated and organised under the laws of Sweden and qualifying as an alternative investment fund incorporated under the laws of Sweden (the "Master Fund") and being managed by Finserve Nordic AB.

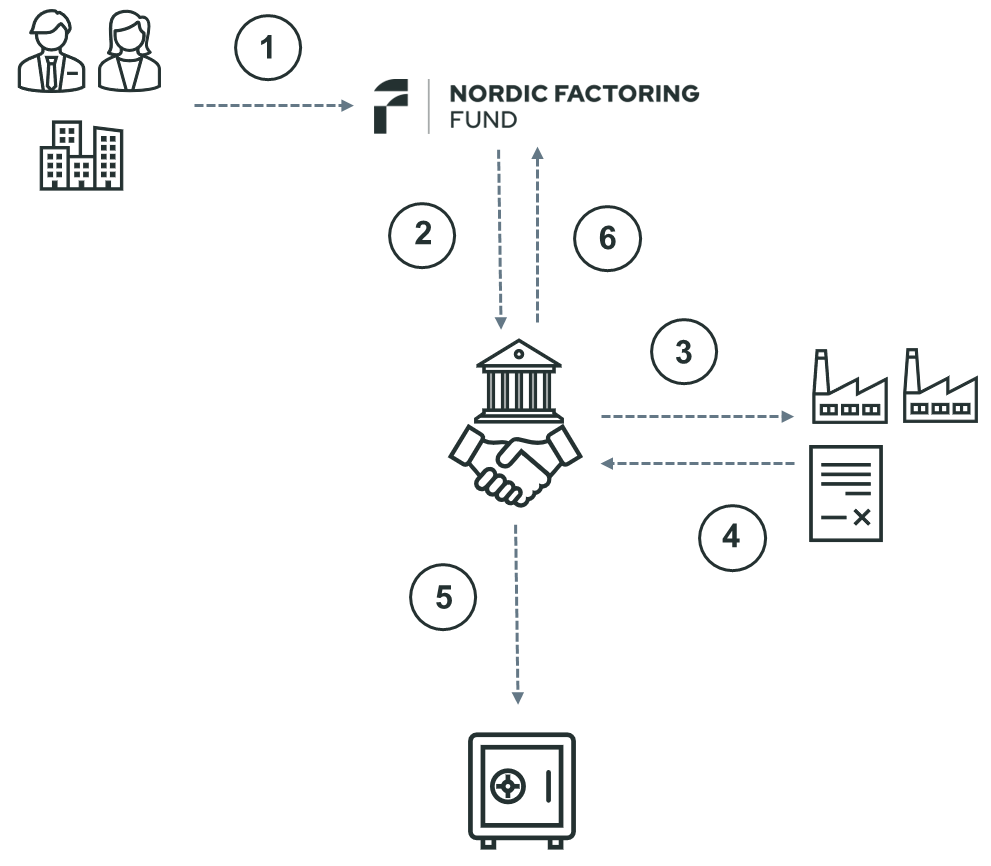

This is how the fund generates returns in 5 steps

- The investor buys shares in the fund

- The fund has agreements with operators or factoring companies that through factoring acquire invoices from companies approved by the fund

- The factoring company ensures that the invoice recipient confirms receipt of the goods or service before the invoice is financed

- The invoices are pledged in the name of the fund and serve as security

- The factoring companies ensure that the invoices are paid by the end customer they are issued to and the fund receives interest on the invested capital

- The interest income generated in the fund primarily constitutes the change in the fund's net asset value (NAV) and thus the investor's return over time

Investment Strategy Advantages

INSIGHT INTO CASH FLOW

Through invoice financing, the financier gains a unique insight into the counterparty's cash flows through payment and sales patterns. This direct analysis of a company is not available in any other financing alternative.

RISK IDENTIFICATION

Due to the direct visibility into companies' payment patterns, the fund can rapidly identify emerging risks. This is evident through the fund's 0% credit losses.

CLEAR PURPOSE

The purpose is clear and confirmed by the counterparty. The factoring company ensures that the customer to whom the invoice is issued has received the goods/services, confirming the security of the financing both in terms of payment responsibility and legality.