September

The NAV price for the fund's A class was 114.96 in September. The fund's A class lost 2.19% in September and since the beginning of the year has returned 9.43%, which is 13.38 percentage points better than the fund's reference index OMX Small Cap. OMX Small Cap GI went down during the month by 8.65%

| September | This year | Fund start Dec 2023 | |

| OMX 30 GI | 1,17% | 12,48% | 16,52% |

| OMX Small Cap GI | -8,65% | -3,95% | 0,80% |

| Sweden Micro Cap Inveztly* | -2,35 | 4,22% | 11,28% |

| Finserve Micro Cap A | -2,19% | 9,43% | 14,96% |

*Sweden Micro Cap Investly is an index proxy that reflects a Swedish micro cap index with company values between 50 msec - 3.5 mdr.

Best and worst entries in the portfolio

Best contribution (Weight in the portfolio):

- Bioinvent International AB: 0.18% (0.96%)

- Samhällsbyggnadbolaget i Norden 0.18% (0.72%)

- Brinova Fastigheter AB: 0.18% (1.37%)

- Heba Fastighets AB: 0.13% (1.48%)

- Logistea AB: 0.13% (0.86%)

Worst company (Weight in the portfolio):

- Vicore Pharma Holding AB: -0.31% (0.56%)

- Netel Holding AB: -0.21% (1.23%)

- Wästbygg AB: -0.19% (0.65%)

- Hansa Biopharma AB: -0.18% (0.49%)

- Hanza AB: -0.17% (0.72%)

Index comparison

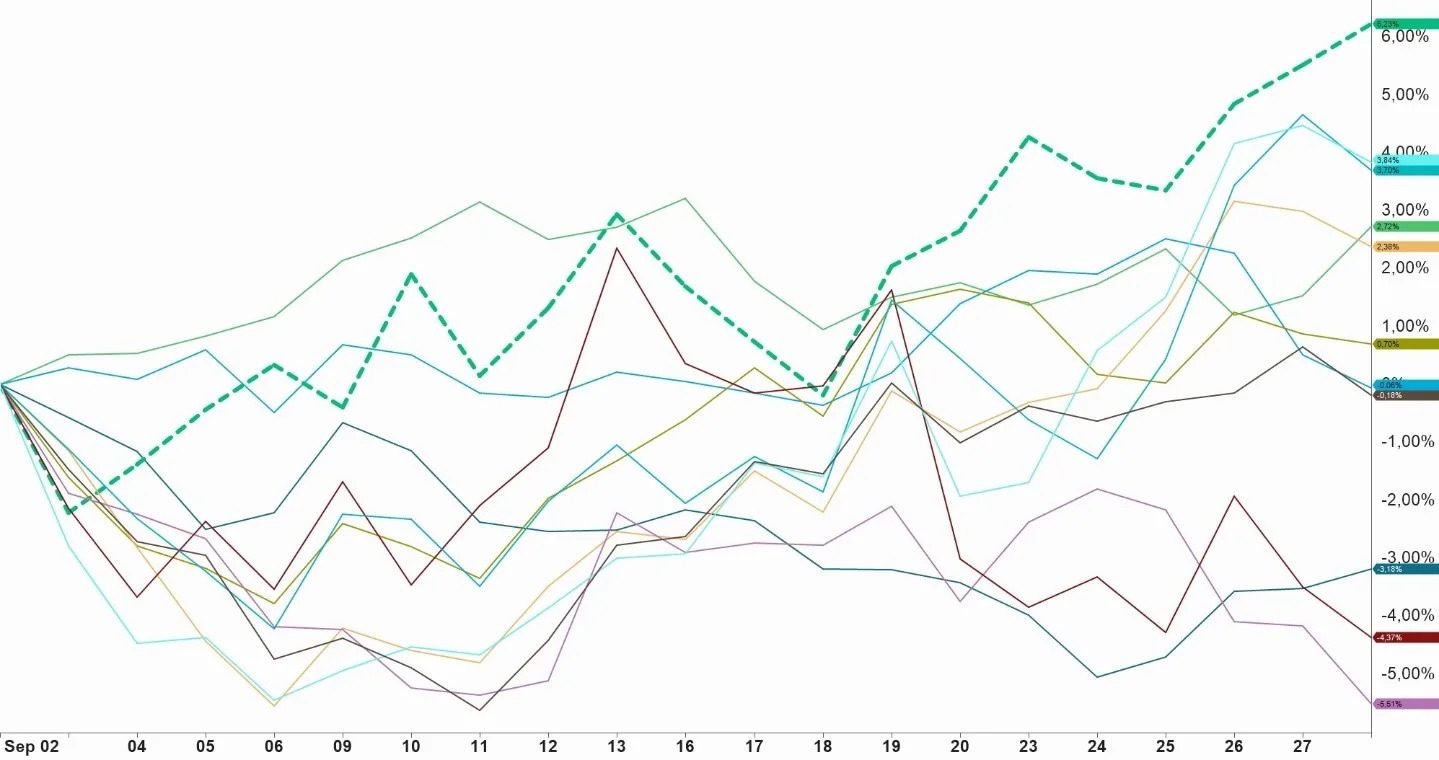

Finserve Micro Cap has OMX Small Cap GI as the benchmark. The difference between larger small companies and smaller small companies is still large and can be measured by looking at the large cap and mid cap index compared to the small cap index. Between mid cap (orange) and small cap (blue), the difference in 2-year history is 43 percentage points. The difference has never been so great since or index started, 2006.

The gap has continued to widen over the past month and the difference on the 3-month history is currently 12%.

The chart shows OMXSSGI in comparison to OMXSMGI. Source: Infront

Small Cap Index: Company value less than approximately SEK 1.5 billion.

Mid Cap Index: Company value between approximately SEK 1.5 and 12 billion.

Large Cap Index: Company value greater than approximately SEK 12 billion.

The market

In September, the US central bank cut interest rates for the first time since the pandemic with an unexpectedly large reduction of 0.5 percentage points. The Fed has signaled that further cuts of a total of 50 basis points could come before the end of the year with more cuts in 2025 and 2026. Global equities rose by 2.4% during the month.

In Europe, the development was weaker, minus 0.55%. Markets lost momentum in September, showing negative local currency results with stagnation in economic growth in countries such as Germany, France and the UK. Although inflation has moderated, investor confidence was weighed down by high personal debt levels and continued high unemployment.

The Stockholm Stock Exchange offered an increase of approximately 1.4%. There is a feeling that the market is waiting partly for clearer economic signals and partly for the upcoming reporting period for the third quarter.

The real estate sector (line in green) was strongest in September, a trend we have observed before. Based on our trend models, we have gradually increased our exposure to this sector and we expect continued positive development in line with future interest rate cuts.

The diagram shows the development of all sectors of the Stockholm Stock Exchange during the month of September. Source: Infront

Forecast

We clearly saw that there is potential in the smallest small companies. Given that the companies included in the OMX Small Cap Index and smaller companies in the OMX Mid Cap have significantly lagged behind the performance of larger companies, it is a golden opportunity to consider an investment in smaller small companies. Here is an explanation why:

- Low values: When the OMX Small Cap Index has fallen behind so significantly, it means that many smaller small cap companies are now undervalued compared to larger companies. This creates opportunities to buy these companies at attractive prices before the market corrects itself.

- Potential for recovery: Historically, the indices have moved more in line with each other. If this pattern repeats itself, as many investors seem to believe, the smaller companies included in the Mid and Small Cap indexes could rebound strongly.

- Low interest rates benefit small companies: With more interest rate cuts expected in 2024, smaller companies can get cheaper financing and improved conditions for growth. Small companies are often more sensitive to interest rates than larger companies and can therefore benefit more from reduced costs of capital.

- High growth potential: Small companies generally have greater potential to grow faster than larger, more established companies. Many small companies have undergone internal structural optimization during periods of high interest rates. Thanks to this, when market conditions improve, small companies can show stronger growth compared to large companies.

- Dynamics of Market Cycles: After smaller caps underperform for a period, we often see them rebound more strongly than larger caps when market conditions improve. This cyclical movement means that small caps may now be facing a period of outperformance, giving investors the opportunity for higher returns going forward.

We see a clear positive trend among the real estate companies and we believe that they, together with the health care companies, will benefit the earliest from lower interest rates. Our models have identified this, which has led to a higher exposure to just these two sectors compared to other sectors.

If you want to read more about the potential of small companies, listen to our manager Joakim Stenberg's latest participation in Placerapodden, Swedish small companies are the best in the world | Place

Did you know that?

Small companies receive ongoing less monitoring by bank analysts and that this creates higher risk for the companies but also higher return potential?