There are often many small companies that shine green when the market declines.

At the end of October, the NAV price for the fund's A class was 115.99. During the month, the A class fell by 1.34 % and is up 7.82 % since the beginning of the year. Since its inception in December 2023, the fund has outperformed its reference index, OMX Small Cap GI, by approximately 5.73 percentage points.

Despite a portfolio consisting of 110 companies, the fund is one of the best performing Swedish micro cap funds this year – and also with the lowest risk in the category.

Market: Swedish small companies and the global market – October

During October, the Swedish companies in the Small Cap index performed weaker than both the larger small and large cap indices. The Small Cap index continues to lag the Mid Cap and Large Cap indices over 1, 3 and 5 year horizons. This indicates that investors still prefer larger companies with stable earnings over smaller growth companies with a higher risk profile.

Despite the market being characterized by some unease, the major stock market indices continued to reach new record levels.

Global markets were generally positive, driven by strong quarterly reports from several major US technology companies and increased expectations of a soft landing in the economy. Interest rates remained high, but investors began to price in possible rate cuts in 2025.

However, uncertainty surrounding the geopolitical situation and the global growth rate remains, which contributed to periodically increased volatility during the month.

Results

Return after fees, Class A

| October | 2025 | Since the fund's inception, Dec 2023 | |

| OMX 30 GI | 4,07% | 14,70% | 26.89% |

| O MX Small Cap GI | -1,08% | 15,04% | 10.27% |

| OMX Mid Cap GI | 2,20% | 8,80% | 37,06% |

| Finserve Micro Cap A | -1,34% | 7,82% | 15,99% |

The fund is nearly fully invested over time, thanks to access to a credit facility with a Swedish investment bank. This makes a significant difference to the fund's return, as it can be fully invested even during subscriptions and redemptions – thus avoiding holding unnecessary cash.

All capital added to the fund is invested exclusively in companies with a clear positive trend, based on the fund's systematic model. When a position grows too large, it is scaled down to even out the risk level in the portfolio. In this way, exposure to trend-setting holdings is maintained, while reducing overall risk.

The smallest small-cap stocks in the portfolio often exhibit low market correlation and are more affected by company-specific factors. Several of these have performed positively despite a weaker stock market climate, strengthening the fund's independence from broad market movements.

The company overlap with other micro cap and small company funds is small, which makes the fund well suited to combining with other funds in a diversified portfolio.

The average weight of the portfolio holdings during March was 0.97%. The table below shows the best and weakest holdings of the month. The fund works systematically to increase exposure to companies in strong trends, which minimizes exposure to weak stocks – a strategy that has historically contributed to stable excess returns over time. The fund has a realized 60-day volatility of 12%, which can be seen as low compared to indexes and other equity funds.

Best companies in the portfolio and average weight during the month

| Name | Return Oct% | Contribution % | Weight % |

| Saniona AB | 37,38 | 0.68 | 1,93 |

| Studsvik AB | 35,10 | 0,46 | 1,64 |

| Cantargia AB | 32,17 | 0,32 | 0,86 |

| Hanza AB | 29,34 | 0,31 | 1,05 |

| Catena Media PLC | 27,83 | 0,29 | 0,91 |

Worst company in the portfolio and average weight during the month

| Name | Return Oct% | Contribution % | Weight % |

| Hansa Biopharma AB | -11,59 | -0,24 | 1.18 |

| Net Insight AB | -20.93 | -0,24 | 2,14 |

| Viaplay Group AB | -23,59 | -0,30 | 1,30 |

| Tobii AB | -40,32 | -0,32 | 0.67 |

| Xspray Pharma AB | -57,17 | -0,40 | 0.70 |

What happens when the stock market falls sharply one day?

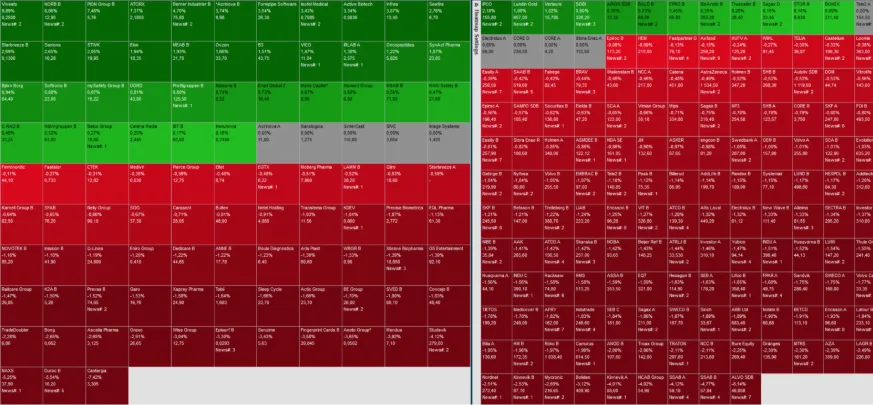

The image shows the development on Tuesday, November 4, for OMX Small Cap (left image) and OMX Large Cap companies (equal weighted).

You can clearly see that several Small Cap companies are green. This partly illustrates why Small Cap indices tend to outperform over time – they simply don't fall as much as Large Cap indices in weaker markets. Companies in Small Cap indices often have lower liquidity, fewer institutional owners and higher company-specific risk than Large Cap companies.

Therefore, a combination of small and large companies can contribute to a more efficient and balanced portfolio.

The companies included in the Small Cap index (106 shares) compared to the Large cap index (152 shares). Source: Infront, date. 20251104

Did you know that: There are around 1,000 Swedish listed small companies. The companies included in the OMX Small Cap Index are listed on a so-called regulated market, which places higher demands on corporate governance. This in turn means a lower risk of bankruptcy compared to companies listed outside the regulated market.

Strategy

The fund's goal is to achieve good risk-adjusted returns, offer equity exposure to companies that few other funds own, and to weather downturns well through equal weighting and even sector exposure.

The fund rebalances all positions every six months. Historically, the strategy of equal-weighting a broad equity portfolio has resulted in higher risk-adjusted returns compared to market-value-weighted broad portfolios. This outperformance can be attributed to the strategy's ability to better handle downturns, unlike value-weighted portfolios that are often heavily concentrated in individual stocks. The strategy is based on trend-following investments between equal-weightings, focusing on companies that exhibit low volatility and a clear positive trend.

Finserve Micro Cap invests in companies listed on the regulated market. The portfolio consists of more than 100 companies listed on the OMX Small Cap and OMX Mid Cap lists over time. The companies in the portfolio have an average company value of approximately SEK 2.5-3.5 billion over time. This value is significantly lower than the average among competitors' micro cap and small company funds.

Thanks to regular equal weighting, the trend strategy and the fact that the fund is one of the few fund owners in many of the companies, the fund has a low correlation with traditional micro cap and small cap funds.