The genuine small companies have never been as cheap as now?

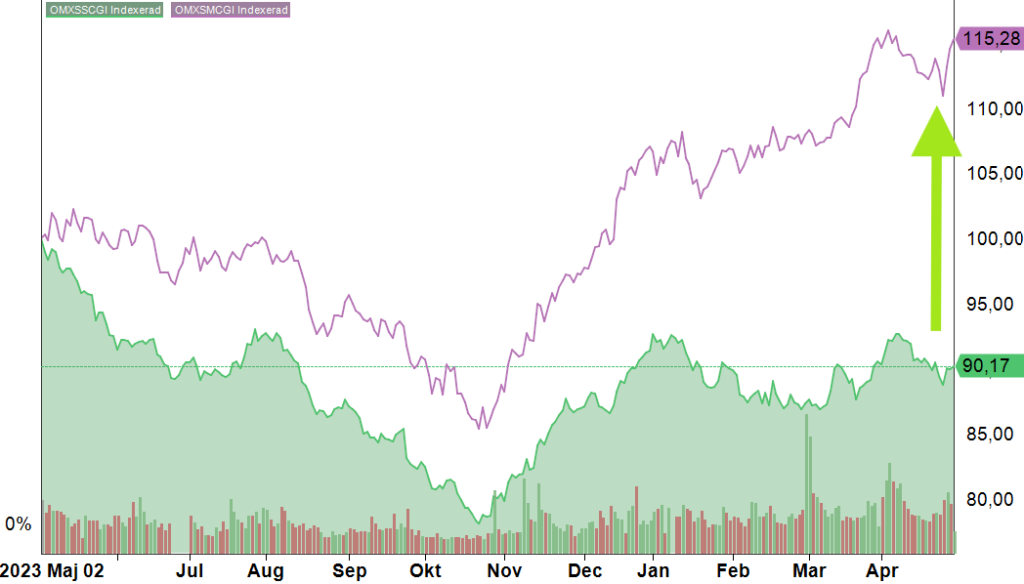

The smaller small caps are now more affordable than ever before if you look at their key figures in comparison to Large Cap and larger Mid Cap companies. Looking back one year, the difference in value performance between the Small Cap and Mid Cap Index is approximately 25 percentage points, which is a remarkable deviation. This significant difference on a monthly basis has never occurred before since the respective NASDAQ indexes were established in 2006. If you review the history from the index's inception in 2006, the difference amounts to approximately 200 percentage points, which is the largest difference to date. Historically, the indexes have tracked each other well, so a logical conclusion is that the Small Cap index should approach the Mid Cap index through a rise or the Mid Cap index should fall. We believe in the first option, and that the smallest small companies, the micro cap companies* will benefit from a reduction in interest rates and a reduction in the return requirement.

Period: 20230429-20240430 OMX Small Cap Index (green) compared to OMX Mid Cap Index (small).

Source: Infront

April

The fund reports a NAV rate for April of 106.34. During the month of April, the stock exchange was on hold, waiting for the Riksbank's interest rate announcement. The fund's A-class lost 0.78%, which was slightly more than the reference index, Nasdaq OMX Small Cap, which ended at m minus 0.6% during April. OMXS30, index of the 30 largest companies on the stock exchange, increased by 1.9 %. In the year, the fund's A class is up 1.23% which is 1.54% better than the reference index.

Best and worst companies in the portfolio during the month:

| Best company | Return during April |

| BIOINVENT INTERNATIONAL AB | 49% |

| SEDANA MEDICAL AB | 32% |

| TOBII AB | 32% |

| VNV GLOBAL AB | 31% |

| TF BANK AB | 26% |

| Worst company | Return during April |

| DEDICARE AB B | -44% |

| VIAPLAY GROUP AB | -24% |

| BHG GROUP AB | -24% |

| CINT GROUP AB | -23% |

| MILDEF GROUP AB | -21% |

Strategy

The fund carries out equal weighting of its positions every six months, and this month the equal weighting has been carried out and all companies have an approximate weight of 0.8 %. Historically, the strategy of equal weighting a broad equity portfolio has resulted in a higher risk-adjusted return compared to portfolios weighted by market value. This outperformance is because the strategy is better equipped to handle downturns compared to value-weighted portfolios, which often have a high concentration of individual stocks. The fund aims to weather downturns well through equal weighting and even sector exposure.

The fund's strategy is based on being trend-following between the equal weightings, with a focus on companies that show low volatility and a clear positive trend. The companies that performed best within the trend strategy during April include VNV Global, VBG Group, Railcare Group, Vicore Pharma and Nordic Paper Holding.

Finserve Micro Cap trades companies that exist on the regulated market. The portfolio today consists of 125 companies listed on OMX Small Cap and OMX Mid Cap. The companies have an average company value of approx. 3m.

Forecast

Interest rate cuts may come already during the Riksbank's meeting in May. If it does not come in May, the probability of a reduction in early June is high as the ECB has also flagged for a quick reduction. The market is speculating whether an interest rate cut has already been factored in and that it will not affect the stock market to any great extent.

We believe that interest rate cuts will affect small companies more than large companies. Many small companies that find it difficult to finance themselves. Even if the interest rate difference is low, it will, in combination with the reduction in the required rate of return, make it easier for companies to finance themselves. Another mentioned reason why small companies' turnover will increase is that many small companies in industry, IT and transport have customers who are waiting to place orders based on long contracts that are affected by the interest rate. The more the interest rate falls, the more companies will dare to sign long contracts.

Now is an excellent time to invest in genuine small companies.

Did you know that only 23% of the companies included in the Small Cap Index are analyzed by an average of 1.2 analysts**

*Micro cap companies are companies whose market value corresponds to less than 0.1 % of the total market value on the stock exchange. Today, this corresponds to a company value of approximately SEK 13 billion.

**Registered in Bloomberg as an analyst.

Read myou