The NAV price for the fund's A class was 119.29 in July. The fund's A class rose by 5.39% in July and has been around 6.04 percentage points better than the fund's reference index OMX Small Cap GI since its inception in December 2023.

Market July

Swedish small cap stocks continued to perform strongly in July, driven by improved interest rates and increased risk appetite in the market. Many companies in the segment have a high share of company-specific risk, which has made them less sensitive to broad market movements and macro signals. Inflation has continued to ease, and signals of possible interest rate cuts from the Riksbank have contributed to positive investor sentiment. At the same time, geopolitical concerns increased, especially linked to Donald Trump's statements about new tariffs against the EU, among others, which created some uncertainty about global trade. Despite this, the small cap market has so far held up well, supported by a more stable economic situation and a focus on company-specific value creation.

Results

The fund aims to outperform the reference index (OMX Small Cap GI) by a few percentage points per year at a lower risk than the reference index. You know roughly what you are getting into, as the fund is index-linked, the investor can expect a return similar to the index on average per year. Since its inception in 2006, the OMX Small Cap index has returned approximately 12%/year at a volatility of 17%

The average weight of the portfolio holdings during March was 0.96%. Anything above 0.96% means the fund is overweight the company and below 0.96% means the fund is underweight. The fund has a realized 60-day volatility of 11%.

Return after fees, Class A

| July | 2025 | Since the fund's inception, Dec 2023 | |

| OMX 30 GI | 3,49% | 6,67% | 19,08% |

| OMX Small Cap GI | 5,14% | 18,06% | 12,92% |

| OMX Mid Cap GI | 0,71% | 6,64% | 34,80% |

| Finserve Micro Cap A | 5,39% | 10,88% | 19,29% |

The fund invests exclusively in companies with a clear positive trend, based on technical and quantitative analysis. All capital is directed towards stocks that show strength in price development and momentum. This focused strategy creates good conditions for high risk-adjusted returns with low correlation to broad large cap indices.

The smallest small-cap stocks in the portfolio often have low market correlation and are driven more by company-specific factors. Several of these have performed positively despite a weaker stock market climate, strengthening the fund's independence from broad market movements.

Ahead of August and September – historically weaker months – the fund's total market exposure is reduced through equal weighting. This means that larger positions are scaled down and the portfolio's risk is distributed more evenly. This way, we can maintain exposure to trend-setting holdings while reducing overall risk.

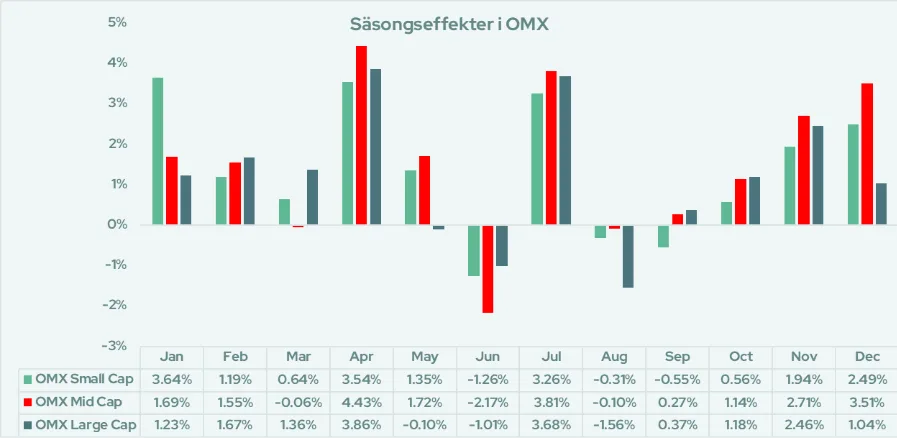

The diagram shows the average monthly return in the various Stockholm indices during the period 2009-2025.

Source: FactSet, Finserve.

The table below shows the best and weakest holdings of the month. The fund works systematically to maintain higher exposure to companies in strong trends and minimize exposure to weak stocks – a strategy that has historically created stable excess returns over time.

Best companies in the portfolio and average weight during the month

| Name | Yield % | Contribution % | Weight % |

| Oncopeptides | 274,51 | 1,35 | 0,71 |

| Nelly Group | 80,73 | 0,75 | 1,30 |

| Berner Industries | 30,36 | 0,54 | 1,32 |

| TradeDoubler | 28,33 | 0,51 | 1,69 |

| Cantargia AB | 130,09 | 0,48 | 0,65 |

Worst company in the portfolio and average weight during the month

| Name | Yield % | Contribution % | Weight % |

| Stillfront Group | -22,43 | -0,23 | 0,72 |

| Ovzon AB | -7,51 | -0,24 | 2,06 |

| ITAB Shop Concept AB | -25,81 | -0.25 | 0,81 |

| Profile Group AB | -7,19 | -0.94 | 1,90 |

| Tobii AB | -30,37 | -2,28 | 2,23 |

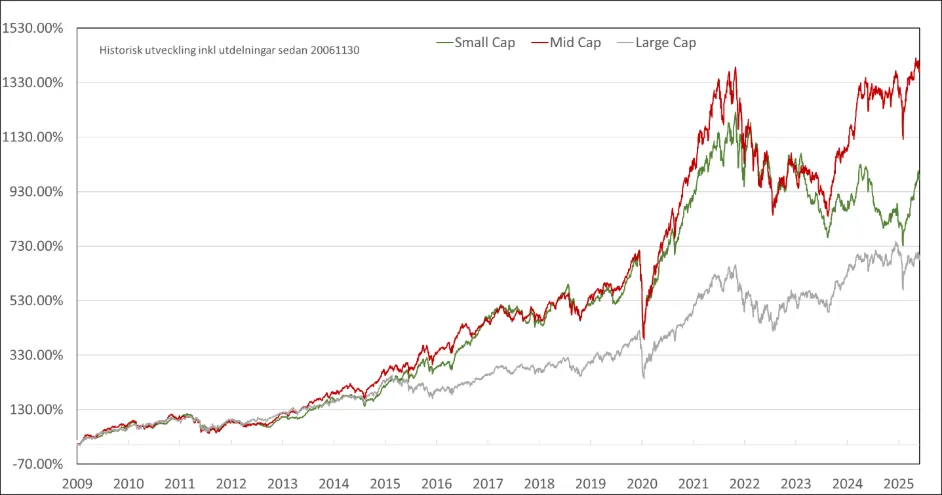

Index comparison – There is potential for recovery for the smallest companies

The gap between the different indices, the so-called spread, remains large between large and small companies. OMX Small Cap performed during the month approximately 5 percentage points better than OMX Mid Cap, and 3 percentage points better than OMX Large Cap.

The chart shows OMX Small Cap (green) compared to OMX Mid Cap (red) and OMX Large Cap (grey) since 20081120. Source: Infront

| Small Cap Index: Company value less than approximately SEK 1.5 billion. |

| Mid Cap Index: Company value between approximately SEK 1.5 and 12 billion. |

| Large Cap Index: Company value greater than approximately SEK 12 billion. |

Did you know that?

Did you know that June, August and September are historically the weakest months of the year for all Swedish stock indices, but for the S&P 500, August and September are the weakest.

Strategy

The fund's goal is to achieve good risk-adjusted returns, offer equity exposure to companies that few other funds own, and to weather downturns well through equal weighting and even sector exposure.

The fund rebalances all positions every six months. Historically, the strategy of equal-weighting a broad equity portfolio has resulted in higher risk-adjusted returns compared to market-value-weighted broad portfolios. This outperformance can be attributed to the strategy's ability to better handle downturns, unlike value-weighted portfolios that are often heavily concentrated in individual stocks. The strategy is based on trend-following investments between equal-weightings, focusing on companies that exhibit low volatility and a clear positive trend.

Finserve Micro Cap invests in companies listed on the regulated market. The portfolio consists of more than 100 companies listed on the OMX Small Cap and OMX Mid Cap lists over time. The companies in the portfolio have an average company value of approximately SEK 2.5-3.5 billion over time. This value is significantly lower than the average among competitors' micro cap and small company funds.

Thanks to regular equal weighting, the trend strategy and the fact that the fund is one of the few fund owners in many of the companies, the fund has a low correlation with traditional micro cap and small cap funds.