First of all, I would like to thank you for another year with your best investors. It is disappointing for us to deliver a weak month on the last day of the year and in the text below you will find an explanation for this.

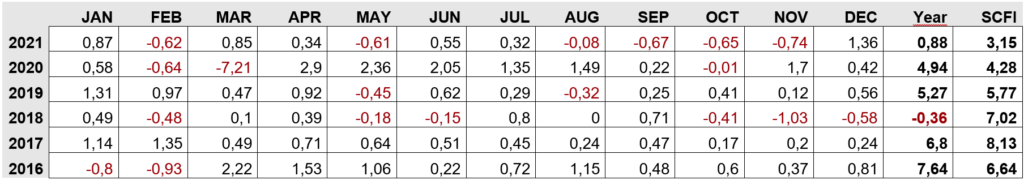

During the month of December, Scandinavian Credit Fund I lost 1.50 percent, which means that the fund's return for 2021 will be plus 3.15 percent.

The weak performance during the month is a result of the IFRS 9 provisions made by the fund in December, which resulted in one of the fund's larger holdings being adjusted downwards in accordance with the prudential principle. We expect that this provision can be fully or partially reversed during the next year, as the company's values become visible, which, all else being equal, could mean an up-valuation of the company in 2022. Provisioning negatively affects NAV in December.

Scandinavian Credit Fund I makes periodic upward and downward revisions of the fund's holdings in accordance with the accounting standard IFRS 9. The purpose of these provisions is to provide as fair a valuation of the portfolio's holdings as possible. However, these revisions are made with the precautionary principle as a guiding principle. The principle means that assets should be valued conservatively when there is uncertainty about the value of the asset, which means that overvaluation of assets is avoided.

As we have concluded in consultation with our external auditor that there is uncertainty about the value of the assets in one of the fund's major holdings, we are making a major write-down of the holding in December in line with IFRS 9 and the precautionary principle. We cannot comment on the underlying holding more specifically at the time of writing, but will return with more information in the near future. Our hope is that this provision is temporary and that all or part of it can be returned to the fund during next year. In other words, it is not a confirmed credit loss but an accounting adjustment.

We are of course not satisfied with the return for Scandinavian Credit Fund I in 2021, but the fund has performed well in terms of return compared to other alternative fixed income funds (see below) during the year. At the same time, the fund's long-term return has been extremely competitive. We expect the fund to reach its target return of over 6 percent in 2022.

In the table below you can see how the fund has performed in relation to other alternative fixed income funds, despite the weaker performance for us in 2021, the fund is far above the average for other alternative fixed income funds. These are funds that are included in Hedge Nordic's index for alternative fixed income funds.

It may seem that the fund's return is going in the wrong direction and I can agree with that, however, there are extraordinary circumstances for this. It should then be mentioned in this context that in 2019 it was Trinitas (fraud, there we are pursuing legal action against the organizer) that pulled the NAV below the target, in 2020 it was Corona and a more exceptional market than that year we as investors will have to look for, in 2021 it is, as mentioned above, a devaluation of a holding after consultation with external auditors. For the investor who was unsure about some holdings, they have now been nailed down again by the external auditor and given unchanged valuations, I expect the fund to reach 6% in 2022.

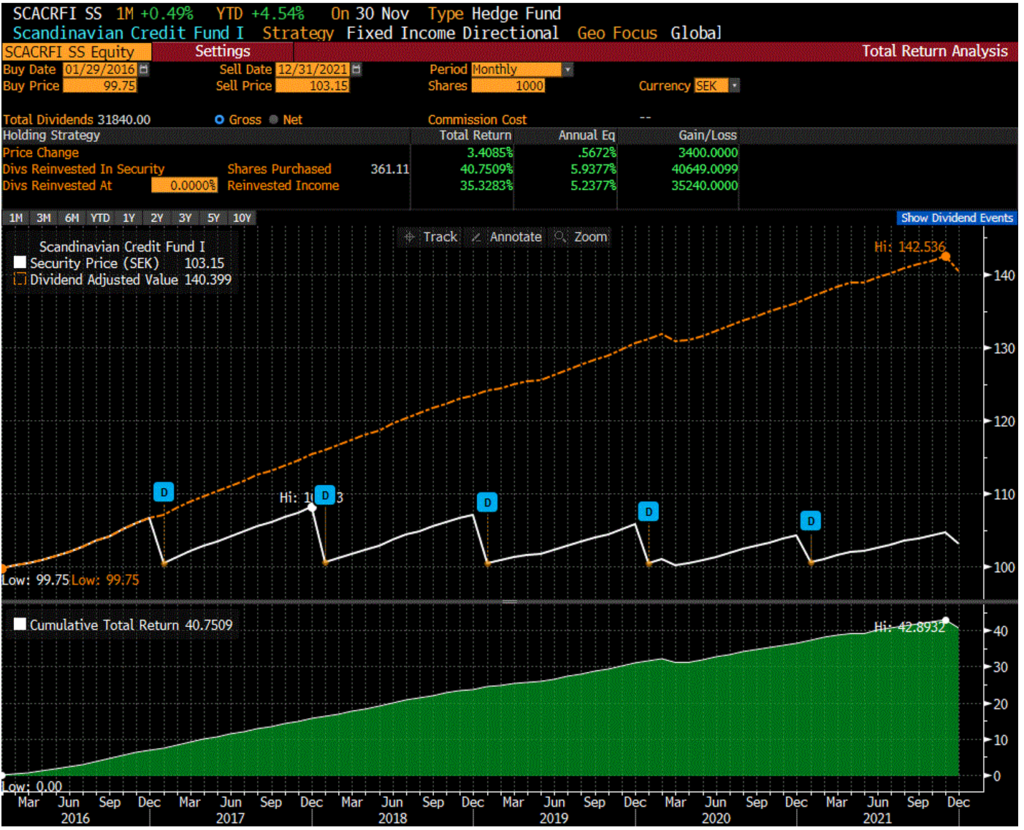

In the graph below you can see that the annual return since inception if you reinvest the dividend in SCF I is almost 6% despite the mediocre finish in 2021.

We continue our work with extra frequent follow-up of our companies with regard to the Corona situation.

Finserve Nordic, which is the fund's AIF manager, has in 2020 joined the company to the PRI network, Principles for Responsible investment. The network is independent but supported by the UN and encourages investors to invest responsibly by following the principles developed by the network.

All funds under Finserve's management follow the responsible investment process formalized in Finserve's Policy for Integration of Sustainability Risks. The policy is available on the company's website https://finserve.se/viktig-information/. Each fund's sustainability policy is available on the funds' websites.

We can announce that based on today's sustainability requirements for funds, Scandinavian Credit Fund I is to be considered a "light green" fund, which is very good. In Sweden, about 30% of all funds have a rating corresponding to light green or better.

When you do your analysis of the fund, you should primarily look at the credit risk and the liquidity risk in the fund. Are you comfortable with the credit risk that the fund's holdings generate? Furthermore, the assets are illiquid and it can take some time to get back your investment if many people want to withdraw deposited funds at the same time. The fund has a low market risk and has a low correlation with other asset classes.

If you need to sell your holdings, do it in the primary market, where you will get the best price.