Scandinavian Credit Fund I AB (publ) reports a NAV rate for August of 104.12 This is an increase of 0.27%.

New subscription in August was about SEK 8 million, many thanks for that.

We are still clocking about 6 %, in this messy environment which is very good. However, with last month's conversion to shares in Vimab, we have had a small setback this month. Last month the conversion contributed to an increase in the return, this month the share has retreated somewhat, which contributes to the worse result.

We had some new lending in the fund during the month of August, in total the new lending amounted to 39m.

Our lending objects are still doing well given the information we currently have, we of course follow all companies as carefully as during covid. It is a new world view and it is important to be one step ahead if possible. We will especially monitor companies that have a high exposure to the electricity market.

The market and the economy

Inflation, interest rate increases, sky-high electricity prices are still in focus. The question economists are now asking themselves is whether there will be a soft landing of the economy or will it be a hard landing. Most economists favor a soft landing, but the risk of a hard landing is significant. And in light of the recent turbulence and announcements of closed industries, as well as the threat of a winter of war (according to our city minister), the danger of a hard landing is imminent.

Households are holding back due to expected interest rate increases and sky-high electricity prices. We also see signs that electricity-intensive industries will have problems in the future. Politicians are trying to pick low-hanging fruit when it comes to energy prices and energy supply. There is a great need to agree and sign a long-term agreement that solves this problem in the best way for Sweden. Adding guarantees to keep the clearing of electricity contracts running is a necessary and good initiative.

The banks come up with forecasts of housing prices that fall by 15-20 %. The stock market has had a relief rally in the last two months but has now shown tendencies to further travel south. Long-term interest rates have started ticking up again. Since the high points at the beginning of the summer, the commodity market has come down a bit, and to some extent alleviated the ravages of inflation. It is really only gas prices and consequently electricity prices that are still hovering around previous peaks. Furthermore, the krona has weakened somewhat, which puts a damper on inflation in Sweden.

The Economic Institute's latest forecast in August shows that the Swedish economy continues to decline. The barometer indicator falls below 100 for August and lands at 97.5, in July the indicator was 101.4.

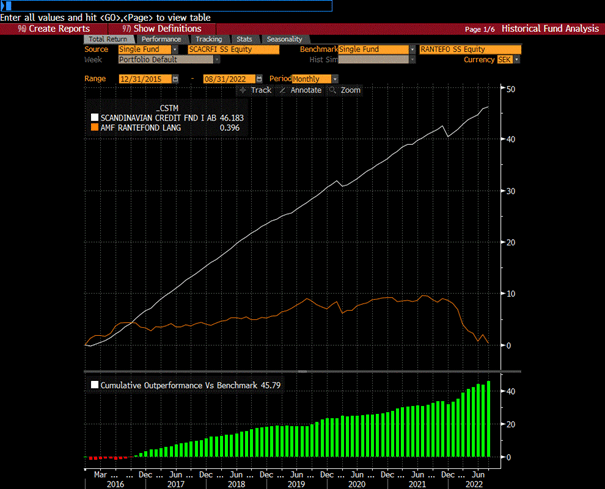

The chart below shows the fund compared to AMF and their long-term bond fund. In this relevant comparison, the fund measures up well.

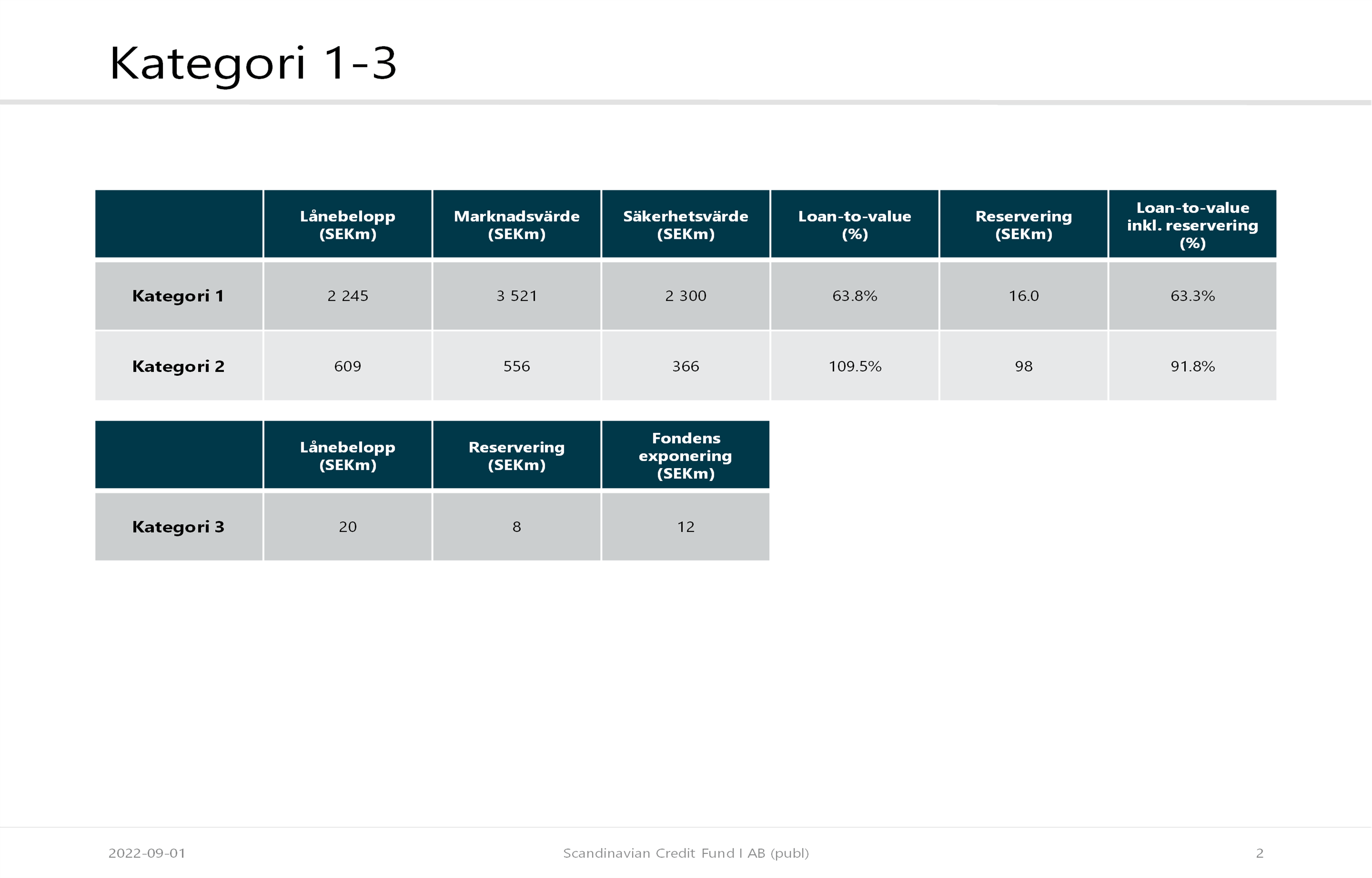

IFRS 9

During August, reservations increased by SEK 445,000. Mostly depending on new lifts and some small adjustments. Otherwise, there have been no major changes. See distribution below between the categories

ESG

Finserve Nordic, which is the fund's AIF manager, has in 2020 joined the company to the PRI network, Principles for Responsible investment. The network is independent but supported by the UN and encourages investors to invest responsibly by following the principles developed by the network.

Finserve Nordic believes that the integration of sustainability risks is an important part of the funds' investment processes. Sustainability risks are defined as environmental, social, or corporate governance-related circumstances that could have a significant negative impact on the value of investments.

Social aspects include e.g. human rights, labor rights and equal treatment. Environmental aspects are e.g. the companies' impact on the environment and climate. Corporate governance aspects are e.g. anti-corruption, shareholders' rights and business ethics

All funds under Finserve's management follow the responsible investment process formalized in Finserve's Sustainability Risk Integration Policy. The policy is available on the company's website https:// finserve.se/viktig-information/. Each fund's sustainability policy is available on the funds' websites.

We can announce that based on today's sustainability requirements for funds, Scandinavian Credit Fund I is to be considered a "light green" fund, which is very good. In Sweden, about 30% of all funds have a rating corresponding to light green or better.

When you do your analysis of the fund, you should primarily look at the credit risk and the liquidity risk in the fund. Are you comfortable with the credit risk that the fund's holdings generate? Furthermore, the assets are illiquid and it can take some time to get back your investment if many people want to withdraw deposited funds at the same time. The fund has a low market risk and has a low correlation with other asset classes.

We emphasize that we are not stressed by non-loaned funds, but continue to work based on our models for credit assessment, all to ensure a good diversification of the portfolio in relation to the credit risk we take.

If you need to sell your holdings, do it in the primary market, where you will get the best price.

The official NAV rate is published on the first banking day of each month, what is shown during the month on NGM is not, I want to emphasize, not always the official NAV rate, as fund shares may have been traded in the secondary market at a different rate than the official NAV.