NAV rate in October was 104.67, which gives an increase for the month of 0.57. An excellent month that is above the rolling twelve-month target of at least 6 percent after fees.

Inflow of SEK 28 million, many thanks for that.

New lending in September was approximately SEK 35 million. The fund is fully invested and everything you deposit now will be put to work immediately.

The market

"Sell on the rumors buy on the facts". That was certainly the theme before, during and after the US election.

The last week of October was the worst for risky assets since March of this year. Stock markets went straight down despite good reports and credit spreads on "high yield" bonds fell apart with price declines as a result.

Vote counting is in full swing but there has been a strong positive turn for risky assets over the past week. Regardless of who wins, major stimulus will need to be injected into the economy. The escalating spread of infection naturally contributes to the uncertainty in the US and globally. However, it seems that most countries "only" close down businesses that make social distancing more difficult. That's good. It is not possible to shut down the economy like last spring, in the end money has no value and then we get other problems that are much worse. The vaccine tests seem to be going well so a launch in Q1 seems very likely.

I've been looking at how the stock market has reacted to surprising news lately. Why am I coming back to the stock market? Well, it affects sentiment in large parts of other asset markets even though it is far from the biggest.

Below you see Affärsvärlden's general index and Citi's surprise index. The connection between surprising statistics and how the index is doing is relatively weak over the past 5 years with mainly two exceptions and one in particular. It was last spring when everything got out of hand. We don't see that today, even though there is a similar case in the index. In my opinion, it depends on the stimulus measures that central banks add and those that are happening and will happen through fiscal policy. So my conclusion from this is that it will be anxious but we will get through this too, a number of experiences richer. In an environment like this, I want to be invested in uncorrelated assets that aren't tossed between hope and despair.

Below you see the same index but for the USA against the S&P index, it shows a similar pattern as in Sweden.

Below you can see the fund's return since inception. It is a very nice curve with a high risk-adjusted return since the start. We are very pleased with that. This shows once again that the fund is a very good investment in a well-diversified portfolio, where the fund acts as an "airbag when things fluctuate in other investments

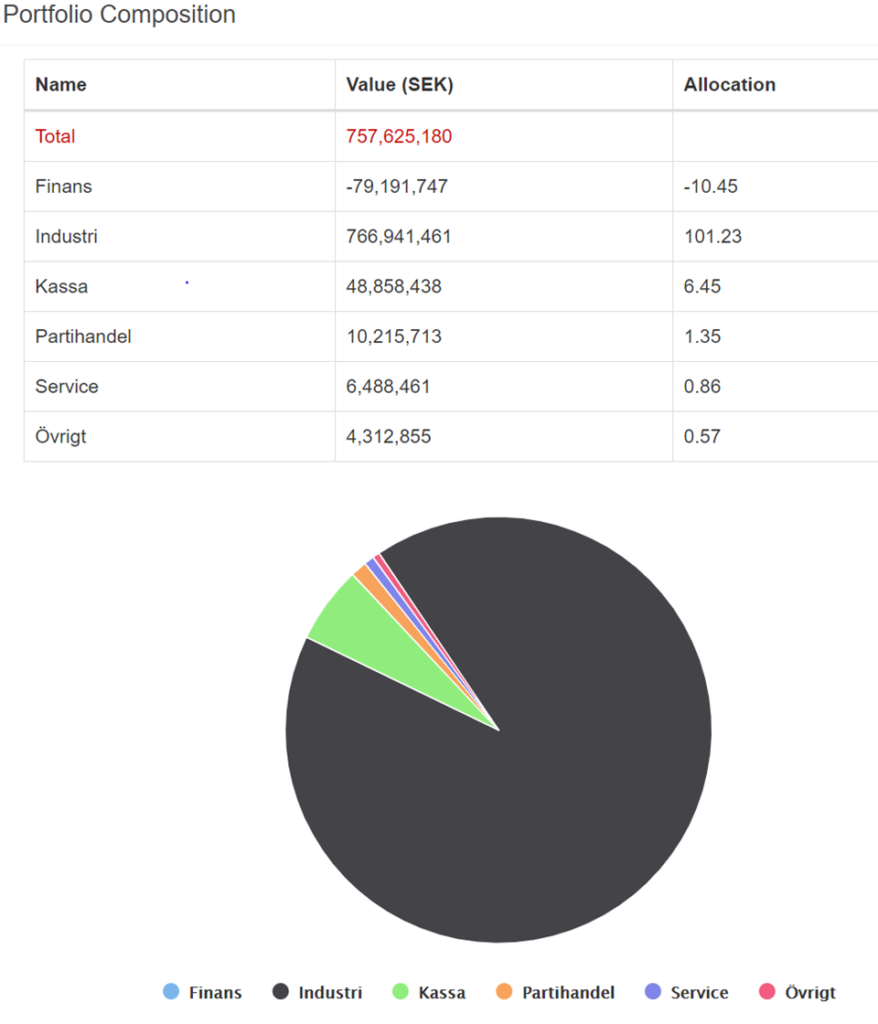

Below you can see the type of companies we finance invoice purchases from:

Return history

[gdoc key=”https://docs.google.com/spreadsheets/d/1wszg2ALhd7L19z-wWVU-2_ygKK4Fj2xGGIg2HpNrBE8/edit#gid=29075506″ class=”table-striped no-datatables” datatables_paging=”false” datatables_ordering=”false” datatables_searching =”false” datatables_info=”false” header_cols=”1″]

Calendar

[elementor-template id=”1257″]