NAV rate in June was 103.38, which gives an increase for the month of 0.57 (0.554%). It's a good month, the fund is progressing according to plan. The difference compared to last month is mainly that May June is one day shorter than May.

Inflow of SEK 18 million, many thanks for that. New lending in February was about SEK 25 million.

We introduce quarterly liquidity in the fund for redemption on 2021-07-01, we maintain the possibility of monthly investments. We continue our work with extra frequent follow-up of our companies with regard to the Corona situation.

The market

Inflation: to rise or not to rise that is the question?

The central banks have repeatedly argued that the upswing we are seeing in inflation is now of a one-off nature and is due to base effects.

They are largely right about that, however the most important component is left out and that is inflation expectations. What is most important for monetary policy is not actual inflation, I believe, but inflation expectations. These govern all actors who set prices on the market. If a producer believes that the price of input goods will rise in the future, he will of course compensate himself by occurring. If there is a shortage of inputs, the producer of these will raise the price until equilibrium is reached, the same applies to final products.

What we are seeing now is a gradual upgrade of inflation expectations and the FED in its meeting on June 16 was the first to acknowledge this and in addition the FED informed the market of upcoming rate hikes in 2023. This was a bit more hawkish than the market expected and above all the dollar has strengthened on this . They had also discussed a reduction in their purchases in the bond market, the timetable for this has not been determined at this time. In summary, we can state that there is disagreement about the future development in the committee and that is always the case when a new possible scenario is discussed. It will affect the markets until the picture becomes clear going forward. Here is a statement from FED chief Jeremy Powell to Congress, taken from the Financial Times on June 22.

"We will not raise interest rates pre-emptively because we think employment is too high [or] because we fear the possible onset of inflation," Powell said during a congressional hearing on Tuesday. "Instead, we will wait for actual evidence of actual inflation or other imbalances."

One factor that could overturn this scenario with rising prices is a new wave of contagion from Covid with new shutdowns as a result and renewed falling growth. For God's sake, let's not see this scenario.

Today there is a shortage of everything from sawn timber to semiconductors and even if sawmills are started, it will take time before these are in production and semiconductor production will of course start in more places than today, it also takes time, etc.

To further highlight a factor that can dampen inflation expectations, this clip below refers to shipping costs that have risen significantly recently. All these factors taken together mean that I am, as before, worried that the central banks will do too little too late.

Finserve Nordic, which is the fund's AIF manager, has in 2020 joined the company to the PRI network, Principles for Responsible investment. The network is independent but supported by the UN and encourages investors to invest responsibly by following the principles developed by the network.

Finserve Nordic believes that the integration of sustainability risks is an important part of the funds' investment processes. Sustainability risks are defined as environmental, social, or corporate governance-related circumstances that could have a significant negative impact on the value of investments.

Social aspects include e.g. human rights, labor rights and equal treatment. Environmental aspects are e.g. the companies' impact on the environment and climate. Corporate governance aspects are e.g. anti-corruption, shareholders' rights and business ethics

All funds under Finserve's management follow the responsible investment process formalized in Finserve's Sustainability Risk Integration Policy. The policy is available on the company's website https://finserve.se/viktig-information/. Each fund's sustainability policy is available on the funds' websites.

We can announce that based on today's sustainability requirements for funds, the Nordic Factoring Fund is to be considered a "light green" fund, which is very good. In Sweden, about 30% of all funds have a rating corresponding to light green or better.

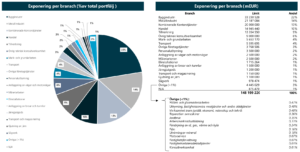

How the fund is invested

The fund's AUM is less than the granted limits of approx. SEK 1.5 billion. This compilation does not come straight out of the system without a lot of manual work so it will not be included every month. It will be interspersed with the usual compilation.

(the fund uses its ability to leverage, hence the positive and negative allocation numbers)