Tough month but many went against the tide

The NAV price for the fund's A class was 99.76 in March. The fund's A class fell by 7.04% in March and has been around 7 percentage points better than the fund's reference index OMX Small Cap GI since its inception in December 2023.

The fund aims to outperform the fund's benchmark index (OMX Small Cap GI) by a few percentage points per year at lower risk than the benchmark index. The average weight of the portfolio holdings during March was 0.97%. Anything above 0.97% means that the fund is overweight the company and below 0.97% means that the fund is underweight. The fund has a realized 60-day volatility of 11.88%.

Return after fees, Class A

| March | 2025 | Since the fund's inception, Dec 2023 | |

| OMX 30 GI | -7,83% | 0,21% | 12,34% |

| OMX Small Cap GI | -7,51% | -2,76% | -6,81 % |

| Finserve Micro Cap A | -7,04% | -7,28% | -0,24% |

Best companies in the portfolio and average weight during the month

| Name | Yield % | Contribution % | Weight % |

| Ovzon AB | 35,97 | 0,31 | 1,12 |

| Mining Joint Stock Company Viscaria | 13,20 | 0,12 | 1,18 |

| Tobii AB | 9,71 | 0,11 | 1,38 |

| Note AB | 6,67 | 0,10 | 1,57 |

| Duroc AB | 2,19 | 0,10 | 0,90 |

Worst company in the portfolio and average weight during the month

| Name | Yield % | Contribution % | Weight % |

| Sedana Medical AB | -57,59 | -0,61 | 0,79 |

| Raysearch Laboratories AB | -10,18 | -0,30 | 1,19 |

| Stillfront Group AB | -28,53 | -0,29 | 0,93 |

| G5 Entertainment AB | -14,29 | -0,26 | 1,45 |

| Enea AB | -13,70 | -0,22 | 1,23 |

Index comparison

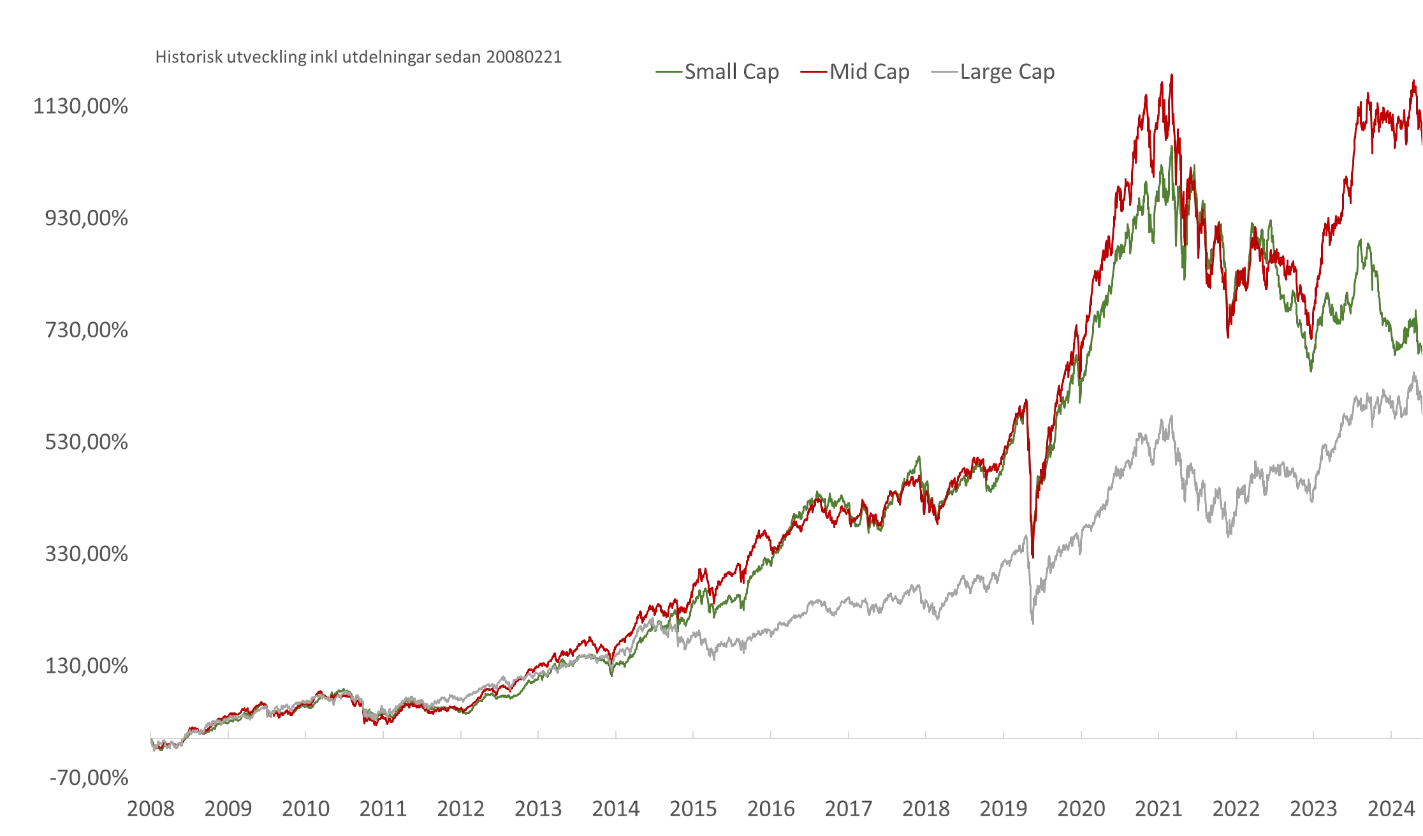

The gap or so-called spread remains large between large and smaller small caps. OMX Small Cap performed marginally better than OMX Mid Cap and OMX Large Cap during the month. There is continued potential for recovery for the smaller small caps that lag behind larger small caps and large caps.

The chart shows OMX Small Cap (green) compared to OMX Mid Cap (red) and OMX Large Cap (grey) since 20081120. Source: Infront

| Small Cap Index: Company value less than approximately SEK 1.5 billion. |

| Mid Cap Index: Company value between approximately SEK 1.5 and 12 billion. |

| Large Cap Index: Company value greater than approximately SEK 12 billion. |

The market

In March 2025, the Trump administration implemented several significant trade policy measures that affected the global economy. Tariffs were imposed on imports from Canada and Mexico and tariffs on Chinese goods were increased. These trade policy decisions during the month contributed to increased volatility in financial markets and created uncertainty about future trade relations and economic growth. This is the theme that will characterize the markets during the spring. In this climate, it becomes even more important to have a diversified portfolio and have exposure to small companies that have historically lower correlation to the broad market.

Forecast

There is clear potential in the smaller small companies, especially given the large index spreads and the implemented interest rate cuts. At the same time, the risk of increased inflation has risen, which can negatively affect the stock market, but the smaller small companies with high company risk and less market risk have the opportunity to go against a negative trend – these are the ones our model identifies, and the fund invests in them when there are inflows.

Currently, the fund has the highest weighting in the IT and consumer sectors, two sectors that, together with the healthcare sector, are strong growth sectors.

Did you know that?

The total market value of the OMX Small Cap Index (105 companies) today is approximately SEK 68 billion. This is the same market value as an individual smaller large cap company, e.g. AB Sagax.

Click on the link to read Finwire's email interview. A systematic strategy for investing in smaller companies – Finserve Micro Cap Fund

Strategy

The fund's goal is to achieve good risk-adjusted returns, offer equity exposure to companies that few other funds own, and to weather downturns well through equal weighting and even sector exposure.

The fund rebalances all positions every six months. Historically, the strategy of equal-weighting a broad equity portfolio has resulted in higher risk-adjusted returns compared to market-value-weighted broad portfolios. This outperformance can be attributed to the strategy's ability to better handle downturns, unlike value-weighted portfolios that are often heavily concentrated in individual stocks. The strategy is based on trend-following investments between equal-weightings, focusing on companies that exhibit low volatility and a clear positive trend.

Finserve Micro Cap invests in companies listed on the regulated market. The portfolio consists of more than 100 companies listed on the OMX Small Cap and OMX Mid Cap lists over time. The companies in the portfolio have an average company value of approximately SEK 2.5-3.5 billion over time. This value is significantly lower than the average among competitors' micro cap and small company funds.

Thanks to regular equal weighting, the trend strategy and the fact that the fund is one of the few fund owners in many of the companies, the fund has a low correlation with traditional micro cap and small cap funds.