Finserve Micro Cap owns a broad portfolio consisting of the "small" small companies on the main list of the Stockholm Stock Exchange.

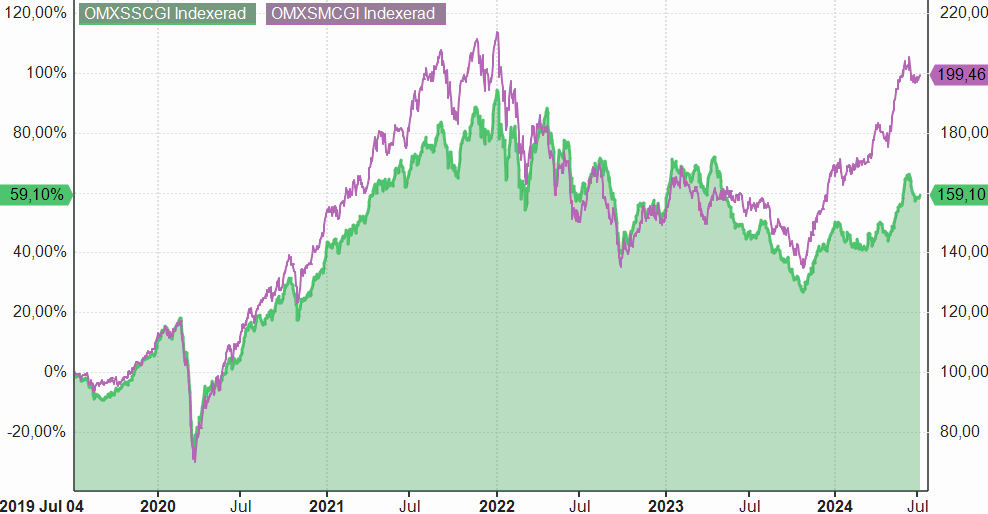

This is the third time we have pointed out that the difference between the Small Cap Index* and the Mid Cap Index** has never been so wide, whether looking at 1-year, 2-year, 5-year or 18-year history. We had expected the difference to decrease, but instead it has increased. These two index series have historically followed each other closely with a few exceptions. The Mid Cap Index has tended to perform stronger when the market has had a strong period. However, the indices tend to converge each time the stock market falls sharply. The reasons for this are debatable. One possible explanation is that the largest Mid Cap companies and the smaller Large Cap*** companies have a large number of funds as owners. The funds have large inflows in the event of positive market development, but at the same time large outflows in the event of market turbulence. These flow-driven movements strongly influence the course development in both directions.

We still believe that the smaller small caps are more valuable than ever before when looking at their ratios compared to large cap and larger mid cap companies. The difference in price development between Small Cap and Mid Cap Index is in 2 years approximately 32 percentage points and increased by 4 percentage points from last month. We will simply have to see if the difference will decrease or increase in line with lower interest rates and reduced yield requirements. The most important thing is that over time we are convinced that the gap will decrease.

Data: 5-year history showing the performance of OMX Small Cap (green) Compared to OMX Mid Cap (purple). The difference in development is 40,36% units. Source: Infront

*Small Cap Index consists of companies that have a company value of less than approximately SEK 1.5 billion.

**Mid Cap Index consists of companies that have a company value between approximately SEK 1.5 and 12 billion.

***Large Cap Index consists of companies that have a company value greater than approximately SEK 12 billion.

June

The stock market had a negative development during the month of June. The NAV price for the fund's A class amounted to 115.03 in June. The fund's A-class decreased by 3.53% in June. Since the beginning of the year, the fund's A-class has a return of 9.51 %, which is 2.3 percentage points better than the fund's reference index OMX Small Cap, which in May fell 3.38%. The OMX Mid Cap index fell 3.21% on the month and the OMXS30, the index of the 30 largest companies on the exchange, fell during the same period by 1.31 %.

Best and worst companies in the portfolio during the month:

| Best company | Return during June |

|---|---|

| Resource Holding | 34,47 % |

| Probi AB | 33,00 % |

| Midsona AB | 25,23 % |

| Cavotec | 15,29 % |

| Hexatronic Group | 14,07 % |

| Worst company | Return during June |

|---|---|

| Aegis Therapeutics | -42,20 % |

| Cint Group | -31,82 % |

| Viaplay Group | -23,27 % |

| Orron Energy | -22,24 % |

| Nobia AB | -19,23 % |

Strategy

The fund carries out equal weighting of all positions every six months. At the turn of April and May, the latest equal weighting was carried out, which resulted in all companies receiving a weight of approximately 0.8 %. Historically, the strategy of equal weighting a broad equity portfolio has resulted in higher risk-adjusted returns compared to market value weighted portfolios. This outperformance can be attributed to the strategy's ability to better handle downturns, unlike value-weighted portfolios that are often heavily concentrated in individual stocks.

The fund's goal is to perform a good risk-adjusted return, offer equity exposure to companies that few other funds own, and to weather downturns well through equal weighting and even sector exposure. The strategy is based on trend-following investments between the equal weightings, with a focus on companies that show low volatility and a clear positive trend. However, in the cases of equal weighting, the trend-following strategy is not applied.

Finserve Micro Cap invests in companies listed on the regulated market. The portfolio currently consists of approximately 125 companies listed on the OMX Small Cap and OMX Mid Cap lists, with an average company value of approximately SEK 2.8 billion. This value is significantly lower than the average among competitors' micro cap and small cap funds.

Thanks to regular equal weighting, the trend strategy and the fact that the fund is one of the few fund owners in many of the companies, the fund has a low correlation with traditional micro cap and small cap funds.

Forecast

"The interest rate controls the stock market, not the other way around." It is likely that there will be more interest rate cuts in 2024, but there were none in June. Despite the unexpectedly high inflation in May, however, the interest rate path was lowered compared to the monetary policy report in March and now signals a high probability (19 points against 12 points in March) of a new cut already at the next meeting in August. The forecast for the end of the year is lowered from 3.27 percent to 3.14 percent. The message in the press release from June 27 is that if the inflation outlook holds up, the policy rate may be lowered two or three times in the second half of the year. In March and May, the message was two reductions. Lower inflation prospects, weaker business conditions and a stronger krona were highlighted as explanations for the lowered interest rate path. The forecasts for 2025 and 2026 are largely unchanged at approximately 2.75 percent at the end of 2025 and just over 2.50 percent at the end of 2026.

That the yield requirement is reduced benefits the stock market in general. The rule of thumb says that if the required return goes down one percent, the stock market goes up 10%. We believe that falling yield requirements and upcoming interest rate cuts will affect the smallest small companies more than large companies. Many small companies find it difficult to finance themselves in this interest rate climate. Even if the interest rate difference is low, it will, in combination with the reduction of the yield requirement, make it easier for companies to finance themselves. The med-tech sector has long been depressed due to low risk appetite and expensive financing, but now we see signs that companies in the sector are recovering.

Now is an excellent time to invest in "genuine" small companies.

Did you know that?

Alfa Laval had a market capitalization in 2003 of SEK 5 billion (Micro cap company). Today, the market value is over SEK 940 billion.

Read myou