Some small companies always go against the grain

The NAV price for the fund's A class was 107.15 in February. The fund's A class fell by 1.69% in February and has been 6.54 percentage points better than the fund's reference index OMX Small Cap GI since its inception in December 2023.

The fund aims to outperform the fund's benchmark index (OMX Small Cap GI) by a few percentage points per year at lower risk than the benchmark index. The average weight of the portfolio holdings during January was 0.93%. Anything above 0.93% means that the fund is overweight the company and below 0.93% means that the fund is underweight. The fund has a realized 60-day volatility of 11.83%.

Return after fees, Class A

| Feb | 2025 | Since the fund's inception, Dec 2023 | |

| OMX 30 GI | 2,12% | 8,7% | 21,49% |

| OMX Small Cap GI | 0,01% | 5,13% | 0,77% |

| Finserve Micro Cap A | -1,69% | -0,26% | 7,31% |

Best companies in the portfolio and average weight during the month

| Name | Contribution % | Weight % |

| Mildef Group AB | 0,48 | 1,46 |

| Humana AB | 0,34 | 1,33 |

| MySafety Group AB | 0,21 | 1,14 |

| Berner Industries AB | 0,21 | 0,90 |

| Attendo AB | 0,20 | 1,06 |

Worst company in the portfolio and average weight during the month

| Name | Contribution % | Weight % |

| Tobii AB | -0,42 | 1,38 |

| Net Insight AB | -0,38 | 1,03 |

| SBB | -0,30 | 0,96 |

| Coinshares International | -0,24 | 0,91 |

| Mangold AB | -0,23 | 0,88 |

The fund does not own the very smallest small-cap companies with extremely low market capitalization and high volatility. Some of them are this year's winners (Actic, Stockwik. Lammhult Design and Havsfrun) and the fund has thus not kept up with the OMX Small Cap Index.

Index comparison

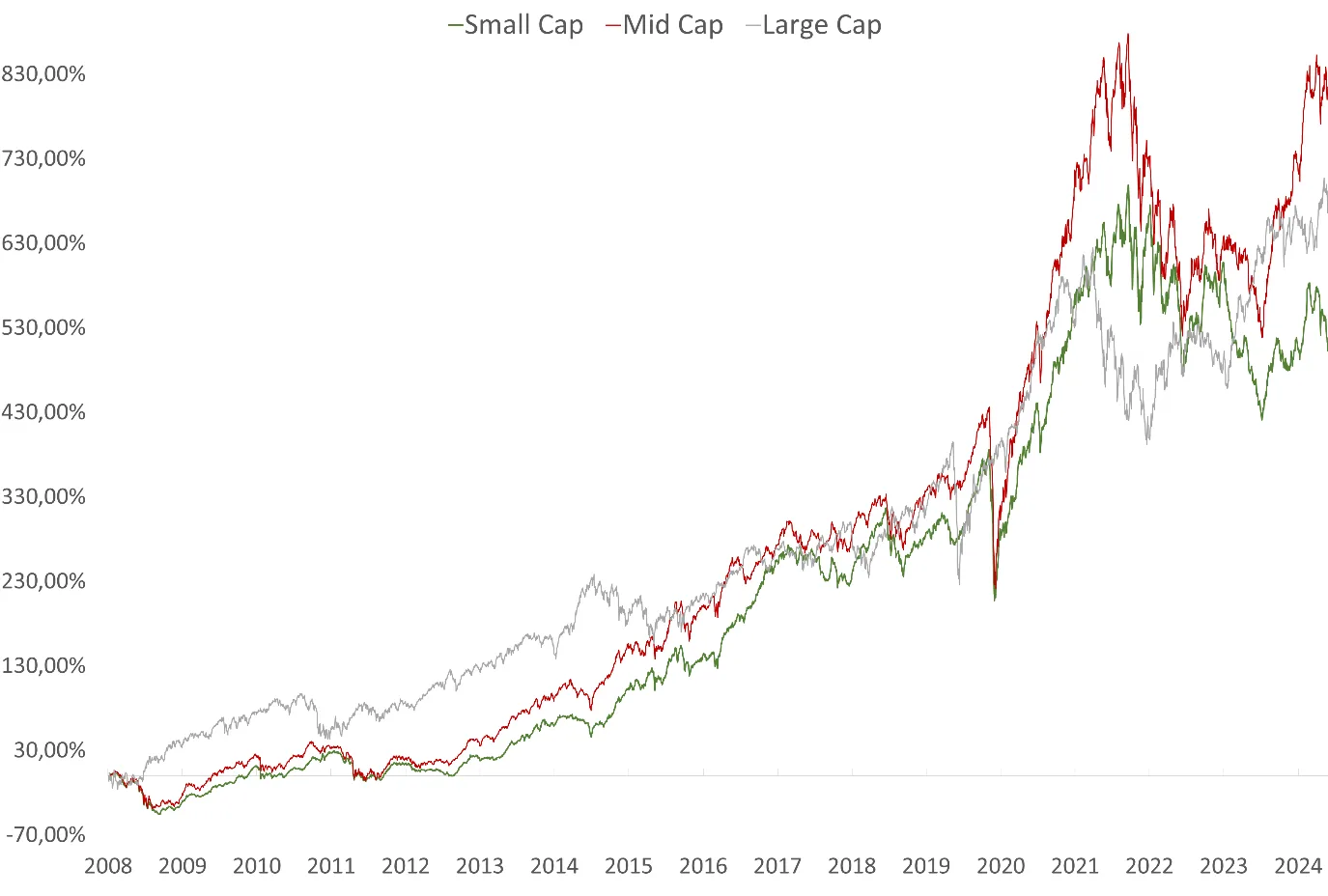

The gap or so-called spread remains large between large and small cap companies. OMX Small Cap lost marginally during the month against OMX Mid Cap and OMX Large Cap. There is continued potential for recovery for the smaller small cap companies that are lagging behind larger small cap companies and large cap companies.

The chart shows OMX Small Cap (green) compared to OMX Mid Cap (red) and OMX Large Cap (grey) since 20061130. Source: Infront

| Small Cap Index: Company value less than approximately SEK 1.5 billion. |

| Mid Cap Index: Company value between approximately SEK 1.5 and 12 billion. |

| Large Cap Index: Company value greater than approximately SEK 12 billion. |

The market

The global market situation is currently characterized by uncertainty, driven by geopolitical tensions, inflationary pressures and central bank monetary policy. Emerging markets are affected by currency movements and commodity prices, while developed economies balance between interest rate cuts and recession risks.

Swedish small companies have had a challenging period due to higher interest rates and a weaker economy, but certain companies with strong business models and international exposure may benefit once the effect of lower interest rates begins to take effect.

Forecast

There is clear potential in the smaller small caps, especially given the large index spreads and the implemented and expected interest rate cuts that many analysts are forecasting. At the same time, the risk of increased inflation has risen, which could negatively affect the stock market.

The smaller small-cap stocks have already fallen sharply in recent years and may continue to fall, but likely to a lesser extent than larger Swedish and global companies. Historically, however, there have always been smaller companies that have gone against the grain as they have high company risk and low market risk – these are the ones our model identifies, and the fund invests in them when there are inflows.

Currently, the fund has the highest weighting in the IT and consumer sectors, two sectors that, along with the healthcare sector, are particularly sensitive to interest rate changes.

Did you know that?

Does the OMX Small Cap Index have the lowest risk compared to the OMX Mid and OMX Large Cap Index?

Source: Infront

Read more at Avanza (Swedish) Avanza Private Banking Blog

Strategy

The fund's goal is to achieve good risk-adjusted returns, offer equity exposure to companies that few other funds own, and to weather downturns well through equal weighting and even sector exposure.

The fund rebalances all positions every six months. Historically, the strategy of equal-weighting a broad equity portfolio has resulted in higher risk-adjusted returns compared to market-value-weighted broad portfolios. This outperformance can be attributed to the strategy's ability to better handle downturns, unlike value-weighted portfolios that are often heavily concentrated in individual stocks. The strategy is based on trend-following investments between equal-weightings, focusing on companies that exhibit low volatility and a clear positive trend.

Finserve Micro Cap invests in companies listed on the regulated market. The portfolio consists of more than 100 companies listed on the OMX Small Cap and OMX Mid Cap lists over time. The companies in the portfolio have an average company value of approximately SEK 2.5-3.5 billion over time. This value is significantly lower than the average among competitors' micro cap and small company funds.

Thanks to regular equal weighting, the trend strategy and the fact that the fund is one of the few fund owners in many of the companies, the fund has a low correlation with traditional micro cap and small cap funds.