Volatility in European defense companies during September was followed by recovery in early October.

The fund had a clear decline in September with a return of -4.63%, mainly due to the volatility of the market for European defense companies. Despite this, the fund has delivered a strong return of 19.85% since the beginning of the year.

We also see that there is volatility on both the upside and the downside. This as European defense companies recovered quickly during the start of October and the fund is up 3 % as of 3 October already and up 23 % for the year.

US defense companies were the biggest contributors during the month and benefited from increased geopolitical uncertainty globally.

Best & Worst performing holdings

| Best positions for the month | Worst positions for the month | |||

| ROLLS ROYCE | 11,82% | ZSCALES | -11,54% | |

| IBM | 9,84% | BABCOCK | -7,15% | |

| SAIC | 8,71% | RHINE METAL | -6,48% | |

| SAFFRON | 8,59% | BAE SYSTEMS | -5,57% | |

| CISCO | 6,29% | SAAB | -5,22% | |

Market development

Global stocks rose by 2.4 % in September mainly driven by the central banks' interest rate cuts. The Federal Reserve beat expectations by cutting interest rates by 50 basis points, boosting investor confidence. Despite mixed economic data in the US – with lower inflation but strong job numbers – the market remained resilient.

In Europe, however, markets slowed and posted losses for the month after a strong start to the quarter. Economic growth stagnated in key economies such as Germany, France and the UK, where high debt and unemployment continued to weigh on investor sentiment despite easing inflationary pressures. Meanwhile, China surprised investors with significant fiscal and monetary stimulus measures in August and September with the aim of reaching its growth target of 5 %. This helped lift the Chinese market by over 23 % in September, further strengthening global investment optimism.

Global Security Fund

European defense companies were negatively affected by rumors of a ceasefire in Ukraine that spread in mid-September, leading to a decline in most European holdings. The drop came after news that Ukraine's allies are considering alternative ceasefire solutions. Later in the month, Ukrainian President Volodymyr Zelensky visited the United States to propose a local ceasefire and a temporary pause in the conflict as part of his broader "victory plan" to bring peace. Despite earlier objections to the ceasefire, Zelensky now showed an openness to considering a pause in the fighting, presenting his plan to President Joe Biden and other key figures.

We see ongoing reactions in European and American defense companies to developments in conflicts. There is a clear diversification value on the upside, but some news gives negative development. The administration's view is that the short-term changes do not affect the long-term investment needs and conditions for the investment theme.

In the portfolio, only Aerovironment reported in September that exceeded expectations. In addition, the company won a contract worth about 1 billion dollars to supply Switchblade missiles to the US Army. Deliveries are expected to begin within a few months and the project should be completed within five years.

Another piece of news was that Italian Leonardo is in talks about planned alliances and joint ventures with European partners, according to CEO Roberto Cingolani. Discussions with Airbus and Thales about potential space industry collaborations continue and a joint venture with Rheinmetall to produce tanks and ground defense systems is expected to be finalized soon. The EU is striving for a stronger European space strategy to compete with the US and China. Leonardo is also working on a new strategic framework for its space division with a plan ready before the end of the month.

Further globally, escalations in the Middle East particularly between Iran and Israel increased the risk of a wider regional conflict. Iran launched a ballistic missile attack in response to Israel's killing of Hezbollah Secretary General Hassan Nasrallah in Beirut, as well as the July 31 assassination of Hamas political leader Ismail Haniyeh in Tehran. Israeli Prime Minister Benjamin Netanyahu immediately vowed to fight back, saying Iran "made a big mistake and will pay for it", while the US stood behind its close ally. The markets reacted negatively to the event. The VIX rose 13 % and Brent oil rose 3.19 % after the attack, recouping most of the decline in September.

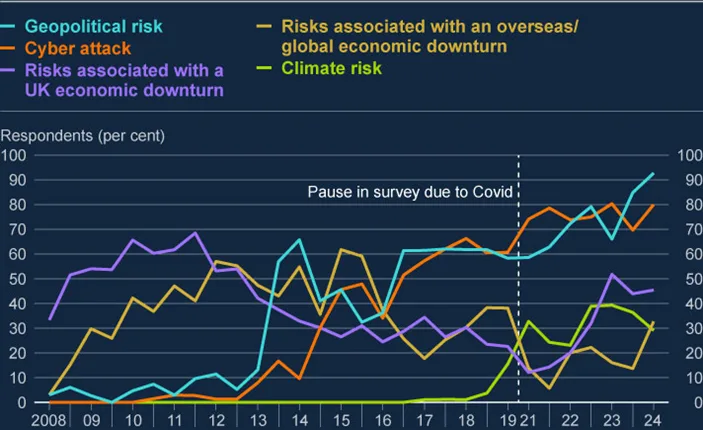

Geopolitical risk

A survey by the Bank of England (BoE), conducted in late July and early August, reflected the growing global concern about geopolitical uncertainty. The BoE found that 93 % of the 55 banks that took part in the survey considered geopolitical risk to be the biggest concern. This is the highest level measured since the survey began in 2008. The increased geopolitical uncertainty could put "further pressure on government debt levels and borrowing costs", the BoE said. It should also be mentioned that they assess that the risks of cyber-attacks are elevated.