Defence shares sharply declined on premature optimism around unpromising talks

During November, defense stocks fell sharply, mainly driven by a market reaction to peace negotiations that quickly proved to lack substance. At the same time, global equity markets were marked by growing concern about long-term profitability in the AI sector, which led to high volatility and profit-taking in several of this year’s strongest sectors, including defense.

Exaggerated fears around peace talks

Concerns that European defense companies would be negatively affected by a potential peace agreement in Ukraine triggered a sharp sell-off in European defense stocks, with spillover effects globally. The peace plan being discussed had clear pro-Russian elements and lacked any form of military or economic pressure on the Kremlin. It also offered no signals of transatlantic strength and unity and consequently had little impact on the peace process. This is further complicated by the assessment that a Trump administration could pursue parallel geopolitical agendas—among other things energy cooperation with Russia and ambitions to weaken ties between China and Russia. Any discussion of peace or a ceasefire must, at its core, be based on Ukraine’s and Europe’s security needs—which is also in the long-term interest of the United States.

No fundamental deterioration—on the contrary, risks increased

During the month, no news emerged that worsened the long-term outlook for global defense companies. Instead, we note that geopolitical risks increased:

- China–Japan: Relations are at their most tense level since 2012, with increased military presence and Japanese defense buildup near Taiwan.

- China–Taiwan: Renewed statements about integrating Taiwan into China.

- Latin America: The Trump administration is considering military intervention in Venezuela, increasing regional concerns.

- Arctic: Increased tension in the Arctic but advancing positions from Russia & China.

These developments do not reduce demand for defense—they reinforce it. The greatest risk is instead that the West’s production capacity cannot be expanded quickly enough to meet needs. This could affect valuations if companies are unable to deliver in line with the estimates embedded in market expectations. However, this differs from company to company.

Our view is that a correction was healthy in a strongly rising market—but this move quickly became an overreaction. Valuations have now come down, and the key drivers going forward are order intake, capacity, and delivery. That sets the stage for future share price performance.

Important: distinguish between peace rhetoric and security policy reality

Even in the event of a ceasefire, the need for European capacity building remains—and in some scenarios could become more urgent. If an end to the war or a pause entails territorial concessions or weak security guarantees, Europe’s security order risks being undermined. That increases the need for defense resources, especially if the United States simultaneously reduces its presence.

In addition, there is the need to rebuild inventories—ammunition, equipment, and supply preparedness. Rearmament is a multi-year process with long lead times. It cannot be switched on and off in line with market narratives.

Structural growth in the defense industry – five fundamental drivers

We identify five fundamental factors that speak for continued strong structural growth in the sector:

- Large defense budgets are adopted within NATO and among allies (3.5%/5%)

- Defense capability is being prioritized long term due to great-power rivalry and a changed geostrategic context.

- Conditions for financing defence investments are improving, making implementation more feasible

- EU spending on R&D has increased by 90% over five years

- Concrete EU initiatives are driving a sustained European ramp-up

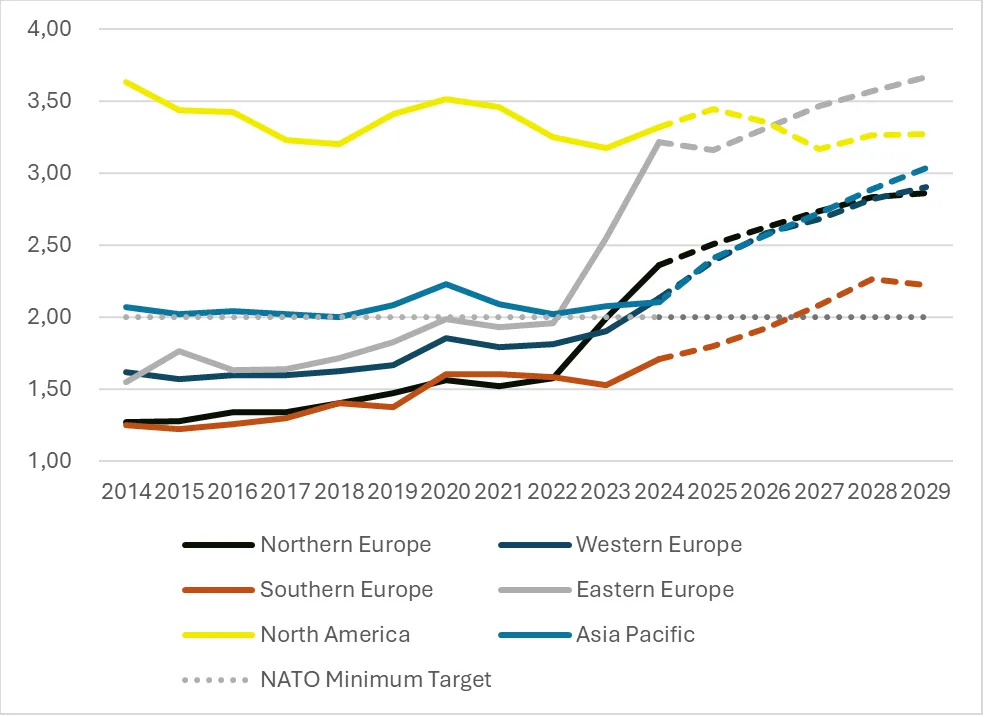

1. Clearer and larger defense budgets are now being anchored broadlyt

Within NATO, higher ambition levels are being discussed and adopted, where levels around 3.5 percent—with add-ons up to 5 percent—are often mentioned as reference points. This is not only a European trend. Similar priorities are also seen within alliances and close partners in the Indo-Pacific region and North America. BlackRock also highlights defense as part of a clear megatrend for the coming years, linked to a more fragmented world order in which geopolitics, trade, industrial policy, and alliances are being reshaped. In their “2026 Global Outlook”, they specifically point to the theme “AI and defense” and describe how rising geopolitical tensions are driving a clearer need for sustained defense investment.

Defense budgets as % of GDP:

Source: NATO (2025), Estimate: Finserve (2025)

”The scenarios presented are calculations of future defense spending based on data from NATO, the IMF and indicated defense spending from states. They are not an exact indicator and actual outcomes may deviate significantly from the forecast above.”

2. As great-power rivalry increases, defense capability becomes a long-term strategic priority

Defense is needed not only to manage conflicts if they arise, but also to reduce the risk that they arise in the first place—through credible deterrence, protection of critical infrastructure, and strengthened resilience in society and the economy.

In the Indo-Pacific, this is particularly evident in Japan–China relations, where tensions have recently increased through a combination of gray-zone activity and more visible military presence. Around the Senkaku/Diaoyu Islands, we see recurring confrontations between coast guard vessels, incursions into territorial waters, and increasingly pressured incidents that test the boundaries between “everyday” activity and escalation.

In parallel, China–Taiwan is another clear fault line driving defense spending and modernization in the region. The risk picture here is not limited to a traditional invasion scenario, but also includes blockade, coercion, cyber operations, and gray-zone measures that can paralyze trade, communications, and critical infrastructure.

3. In Europe, the ability to finance rearmament has improved

In a way that makes investments more feasible even in an environment of strained public finances, the EU has opened for increased budget flexibility by allowing member states to increase defense-related spending and borrowing equivalent to up to 1.5 percent of GDP without impacting the ordinary fiscal frameworks as strongly. In practice, this creates clearer “financial space” for multi-year defense programs. It lowers the threshold for bringing investments forward and makes rearmament less dependent on short-term political priorities in individual budget processes.

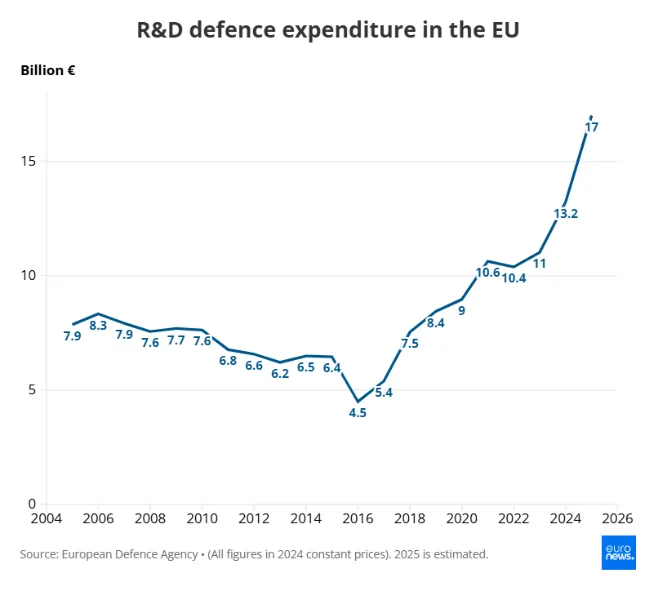

4. The EU’s defense R&D spending has accelerated sharply

This shows the shift is not a cyclical impulse but a structural step-up. Over five years, defense-related R&D in the EU has increased by around 90 percent—from approximately EUR 9 billion in 2020 to around EUR 17 billion in the latest estimates. This is significant because R&D is the most long-term component of the defense budget. It builds next-generation capabilities and creates durable growth in the industry through technology shifts and recurring upgrade cycles.

Sweden is also a clear R&D actor in Europe and ranks in the top tier, in fifth place, underscoring the relevance for Nordic suppliers and the industrial base in the region (Eurostat, 2025).

5. Europe’s structural rearmament is supported by concrete programs

The European Commission's ReArm Europe Plan, Readiness 2030, aims to enable over €800 billion in defence investments, with the loan instrument being a central part. SAFE of up to €150 billion to accelerate investments and joint procurement. The European Commission’s ReArm Europe Plan / Readiness 2030 aims to enable more than EUR 800 billion in defense investments, where a central component is the SAFE loan instrument of up to EUR 150 billion to accelerate investments and joint procurement. In parallel, there are industrial initiatives such as EDIP (European Defence Industry Programme), with EUR 1.5 billion for 2025–2027 to strengthen European defense industry, production, and collaboration. In addition, the EU has established tools to address the most acute bottlenecks. ASAP (Act in Support of Ammunition Production) mobilizes EUR 500 million to increase ammunition production and manage manufacturing bottlenecks. Longer term, the European Defence Fund (EDF) drives technological development with a budget of nearly EUR 7.3 billion for 2021–2027.

Defense is a long-term megatrend

As of November, Global Security Fund is still up 40% year-to-date and continues to have good potential to generate returns going forward for those who believe geopolitical tensions and global great-power rivalry will persist—and that defense budgets will need to keep increasing as a consequence, regardless of whether we see positive outcomes and peace in ongoing conflicts. We believe defense, cyber, and space will likely remain volatile, so investing in the fund should be viewed as a long-term investment horizon of around five years. For a long investment horizon, the sector has strong drivers, as described in this monthly letter.

”"Historical returns are no guarantee of future returns. The money invested in the fund can both increase and decrease in value and it is not certain that you will get back all of the capital invested."”